Question: You have just started your first job, and while retirement seems a long way off you have been told that starting to save now is

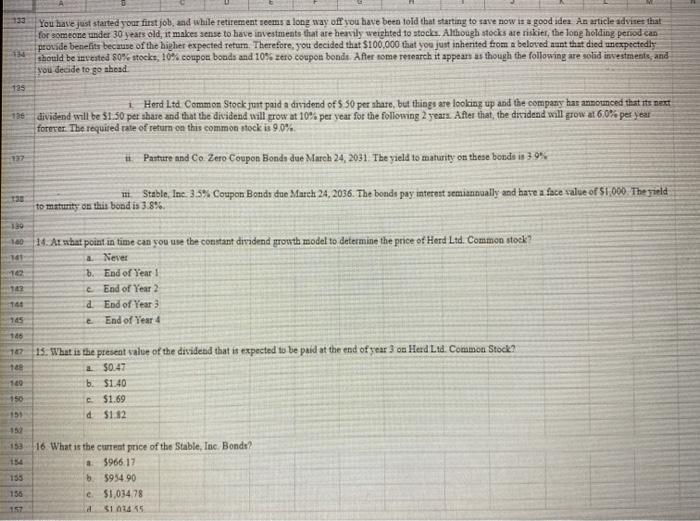

You have just started your first job, and while retirement seems a long way off you have been told that starting to save now is a good idea An article advised that for someone under 30 years old, it makes sense to have investments that are heavily weighted to stocks. Although stocks are riskier, the long holding period can provide benefits because of the higher expected return. Therefore, you decided that $100,000 that you just inherited from a beloved aunt that died unexpectedly should be invested 50% stocks, 10% coupon bonds and 109: zero coupon bonds. After some research it appears as though the following are sold investments, and you decide to go ahead Herd Ltd Common Stock ptant paid a dividend of 5 50 per share, but things are looking up and the company has announced that its next dividend will be $1.50 per share and that the dividend will grow at 10% per vear for the following 2 years. After that, the dividend will grow at 60% per year forever. The required rate of return on this common stock is 90% # Parture and Co Zero Coupon Bondo due March 24, 2031. The yield to maturity on these bonds in 30% TI Stable, Inc. 3.5% Coupon Bonds due March 24, 2036. The bonds pay interest semiannually and have a face value of $1.000. The yield to maturity on this bond is 3.8% 160 16 10 TA 705 16. At what point in time can you use the constant divadend growth model to determine the price of Herd Ltd. Common stock Never . End of Year 1 End of Year 2 d End of Year e End of Year 4 140 TE 108 169 15. What is the present value of the dividend that is expected to be paid at the end of year 3 on Herd Ltd. Common Stock 50.47 b$1.40 $1.69 d $1.12 151 150 155 156 157 16 What is the current price of the Stable, Inc. Bondt? a $966.17 $954.90 c. 51,03478 $1145

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts