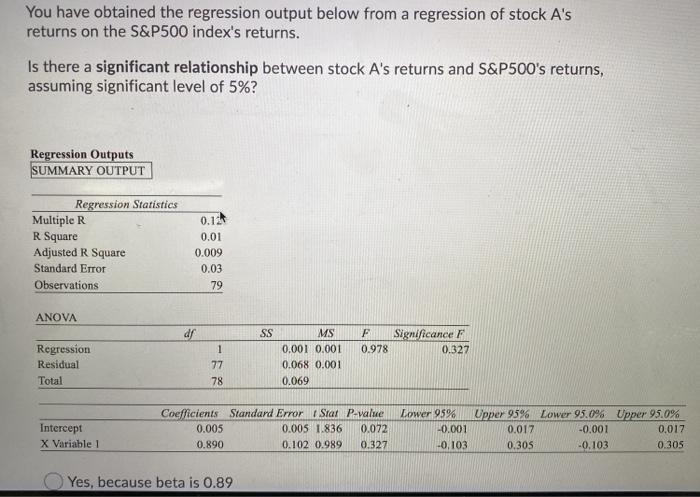

Question: You have obtained the regression output below from a regression of stock A's returns on the S&P500 index's returns. Is there a significant relationship between

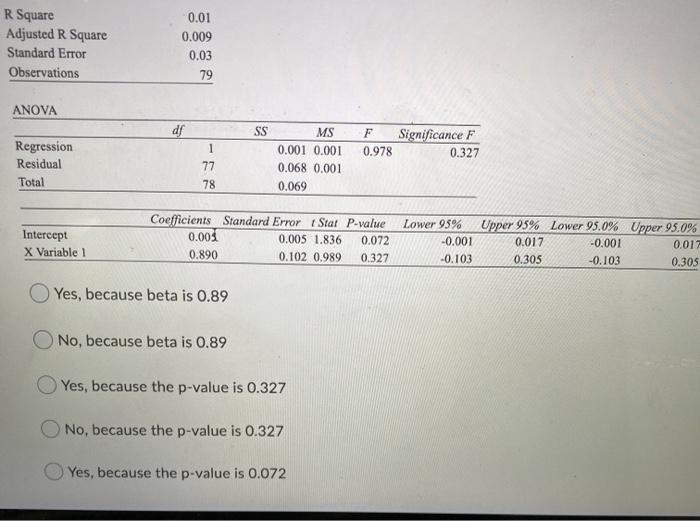

You have obtained the regression output below from a regression of stock A's returns on the S&P500 index's returns. Is there a significant relationship between stock A's returns and S&P500's returns, assuming significant level of 5%? Regression Outputs SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.12 0.01 0.009 0.03 79 ANOVA dr SS F 0.978 Significance F 0.327 Regression Residual Total 1 77 78 MS 0.001 0.001 0.068 0.001 0.069 Intercept X Variable 1 Coefficients Standard Error Stor P-value 0.005 0.005 1.836 0.072 0.890 0.102 0.989 0.327 Lower 95% -0.001 -0,103 Upper 95% Lower 95.0% Upper 95.0% 0.017 -0.001 0.017 0.305 -0.103 0.305 Yes, because beta is 0.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts