Question: You have performed the common sizing and horizontal analysis to the financial statements of FinMan Ltd. You have selectively considered the current (Year O) parameters,

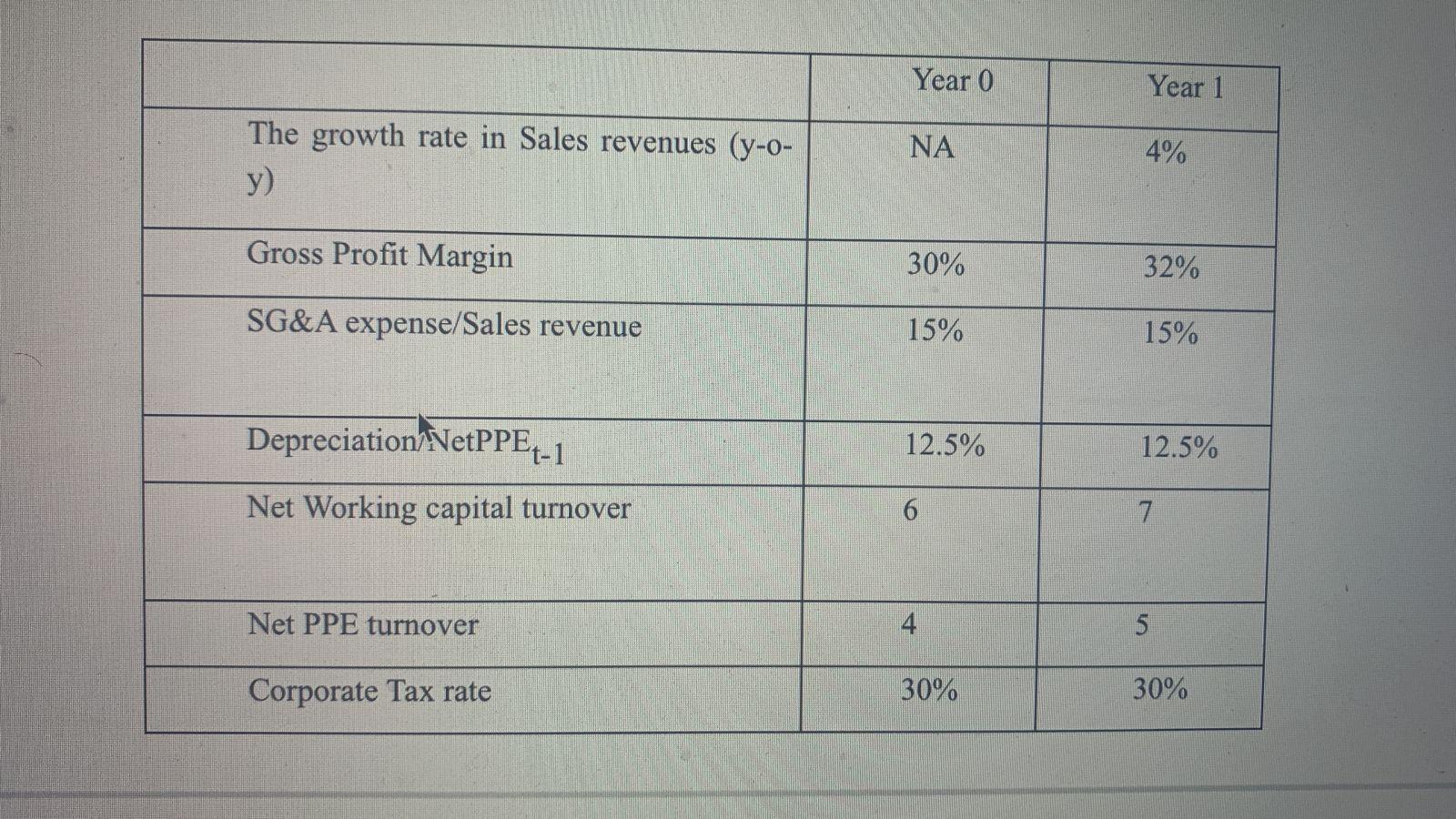

You have performed the common sizing and horizontal analysis to the financial statements of FinMan Ltd. You have selectively considered the current (Year O) parameters, as mentioned in the Table below. Based on the values, you have calculated the Year 1 ratios and growth rates.

Net Working Capital Turnover: Sales revenue/Net Working capital Sales revenue/Net PPE Depreciation/ Net PPE-: Depreciation/ Beginning period Net PPE Sales revenue for FinMan at Year 0 = Rs 1000 million. The growth rate of 4% at Year 1 denotes growth from Year O to Year 1 for Sa Revenue. There are no debt and interest payments. Beginning period Net PPE for Year 0 is Rs 40 crores. Project Sales revenue, Net Profit, Gross Profit, EBIT, Net PPE and Net Working capital values for Year 1.

Net Working Capital Turnover: Sales revenue/Net Working capital Sales revenue/Net PPE Depreciation/ Net PPE-: Depreciation/ Beginning period Net PPE Sales revenue for FinMan at Year 0 = Rs 1000 million. The growth rate of 4% at Year 1 denotes growth from Year O to Year 1 for Sa Revenue. There are no debt and interest payments. Beginning period Net PPE for Year 0 is Rs 40 crores. Project Sales revenue, Net Profit, Gross Profit, EBIT, Net PPE and Net Working capital values for Year 1.

Year 0 Year 1 The growth rate in Sales revenues (y-0- y) NA 4% Gross Profit Margin 30% 32% SG&A expense/Sales revenue 15% 15% Depreciation NetPPEt-1 12.5% 12.5% Net Working capital turnover 6 7 Net PPE turnover 5 Corporate Tax rate 30% 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts