Question

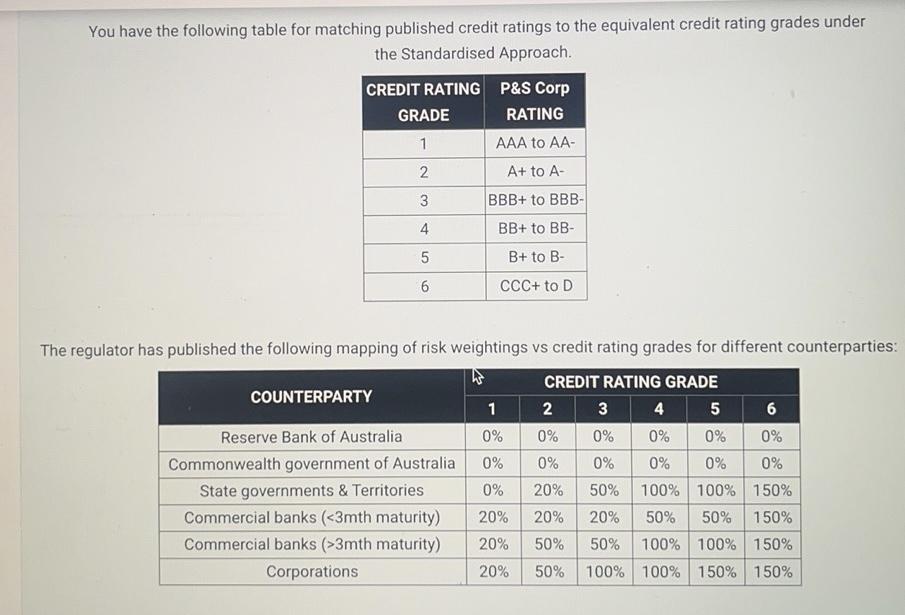

You have the following table for matching published credit ratings to the equivalent credit rating grades under the Standardised Approach. CREDIT RATING GRADE 1

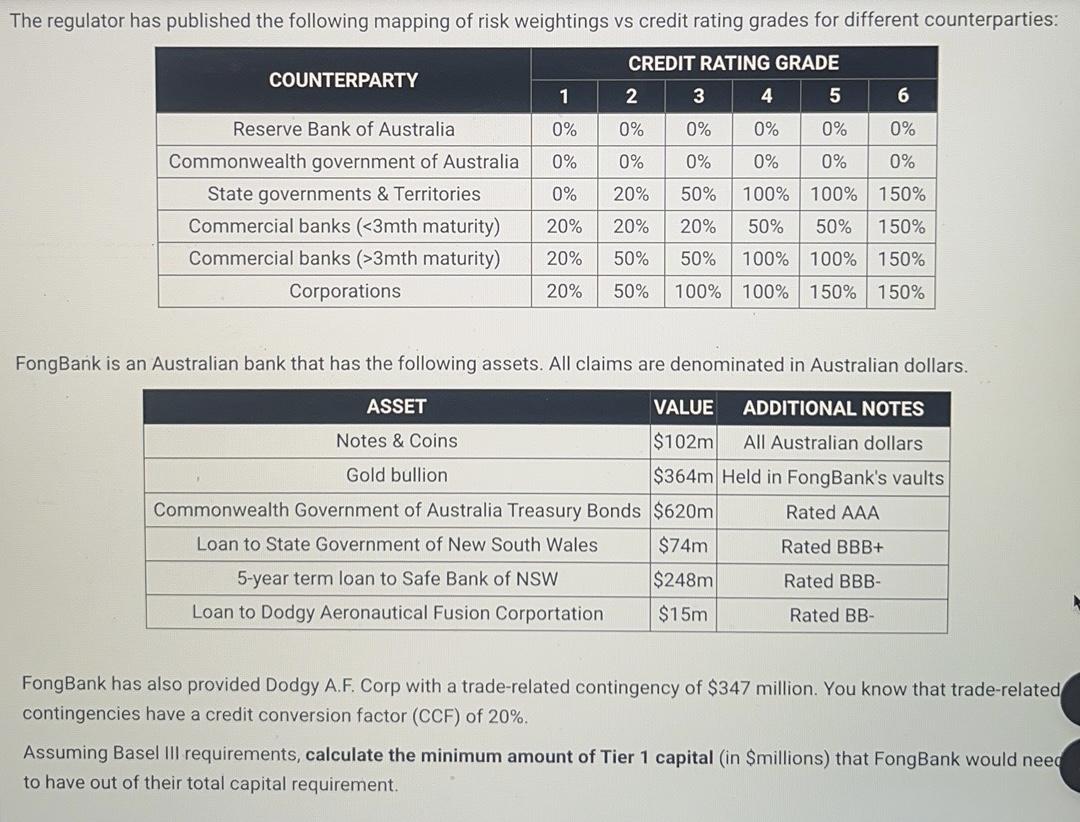

You have the following table for matching published credit ratings to the equivalent credit rating grades under the Standardised Approach. CREDIT RATING GRADE 1 2 3 4 5 6 P&S Corp RATING AAA to AA- A+ to A- BBB+ to BBB- BB+ to BB- B+ to B- CCC+ to D COUNTERPARTY Reserve Bank of Australia Commonwealth government of Australia State governments & Territories Commercial banks ( <3mth maturity) Commercial banks (>3mth maturity) Corporations The regulator has published the following mapping of risk weightings vs credit rating grades for different counterparties: CREDIT RATING GRADE 1 3 4 5 6 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 20% 50% 100% 100% 150% 20% 20% 20% 50% 50% 150% 20% 50% 50% 100% 100% 150% 20% 50% 100% 100% 150% 150% 2 0% 0% The regulator has published the following mapping of risk weightings vs credit rating grades for different counterparties: CREDIT RATING GRADE COUNTERPARTY Reserve Bank of Australia Commonwealth government of Australia State governments & Territories Commercial banks ( <3mth maturity) Commercial banks (>3mth maturity) Corporations 1 2 0% 0% 0% 0% 0% 20% 20% 20% 20% 50% 20% 50% 3 4 5 6 0% 0% 0% 0% 0% 0% 0% 0% 50% 100% 100% 150% 50% 50% 150% 20% 50% 100% 100% 150% 100% 100% 150% 150% ASSET Notes & Coins Gold bullion Commonwealth Government of Australia Treasury Bonds Loan to State Government of New South Wales 5-year term loan to Safe Bank of NSW Loan to Dodgy Aeronautical Fusion Corportation FongBank is an Australian bank that has the following assets. All claims are denominated in Australian dollars. VALUE ADDITIONAL NOTES $102m All Australian dollars $364m Held in FongBank's vaults $620m $74m $248m $15m Rated AAA Rated BBB+ Rated BBB- Rated BB- FongBank has also provided Dodgy A.F. Corp with a trade-related contingency of $347 million. You know that trade-related contingencies have a credit conversion factor (CCF) of 20%. Assuming Basel III requirements, calculate the minimum amount of Tier 1 capital (in $millions) that FongBank would need to have out of their total capital requirement. FongBank has also provided Dodgy A.F. Corp with a trade-related contingency of $347 millio contingencies have a credit conversion factor (CCF) of 20%. Assuming Basel III requirements, calculate the minimum amount of Tier 1 capital (in $million to have out of their total capital requirement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break this down stepbystep A Mapping the credit ratings to grades PS Corp i...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started