Question: you just have 2 hours ?? For each item below, indicate whether it involves: A. A temporary difference that will result in future deductible amounts

you just have 2 hours ??

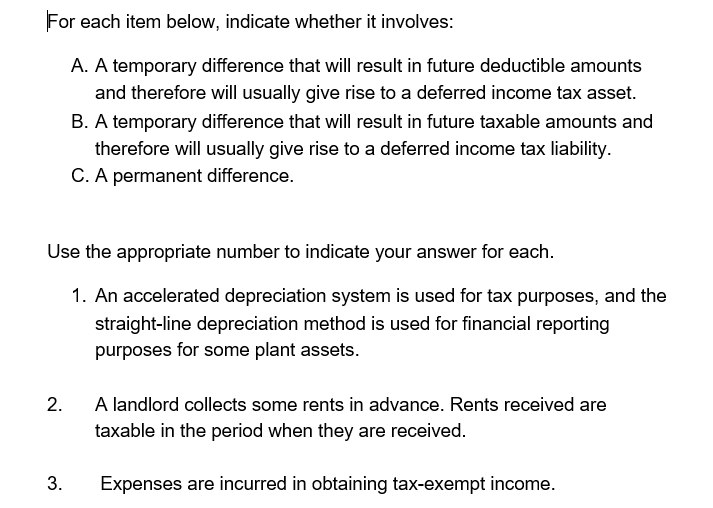

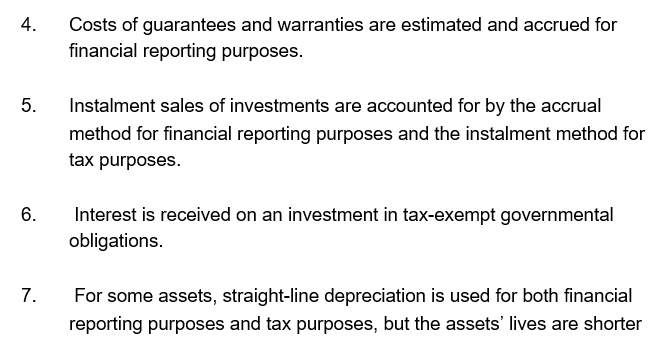

For each item below, indicate whether it involves: A. A temporary difference that will result in future deductible amounts and therefore will usually give rise to a deferred income tax asset. B. A temporary difference that will result in future taxable amounts and therefore will usually give rise to a deferred income tax liability. C. A permanent difference. Use the appropriate number to indicate your answer for each. 1. An accelerated depreciation system is used for tax purposes, and the straight-line depreciation method is used for financial reporting purposes for some plant assets. 2. A landlord collects some rents in advance. Rents received are taxable in the period when they are received. 3. Expenses are incurred in obtaining tax-exempt income. 4. Costs of guarantees and warranties are estimated and accrued for financial reporting purposes. 5. Instalment sales of investments are accounted for by the accrual method for financial reporting purposes and the instalment method for tax purposes. 6. Interest is received on an investment in tax-exempt governmental obligations. 7. For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets' lives are shorter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts