Question: You may need to use the appropriate appendix table or technology to answer this question. The Wall Street Journal reports that 33% of taxpayers with

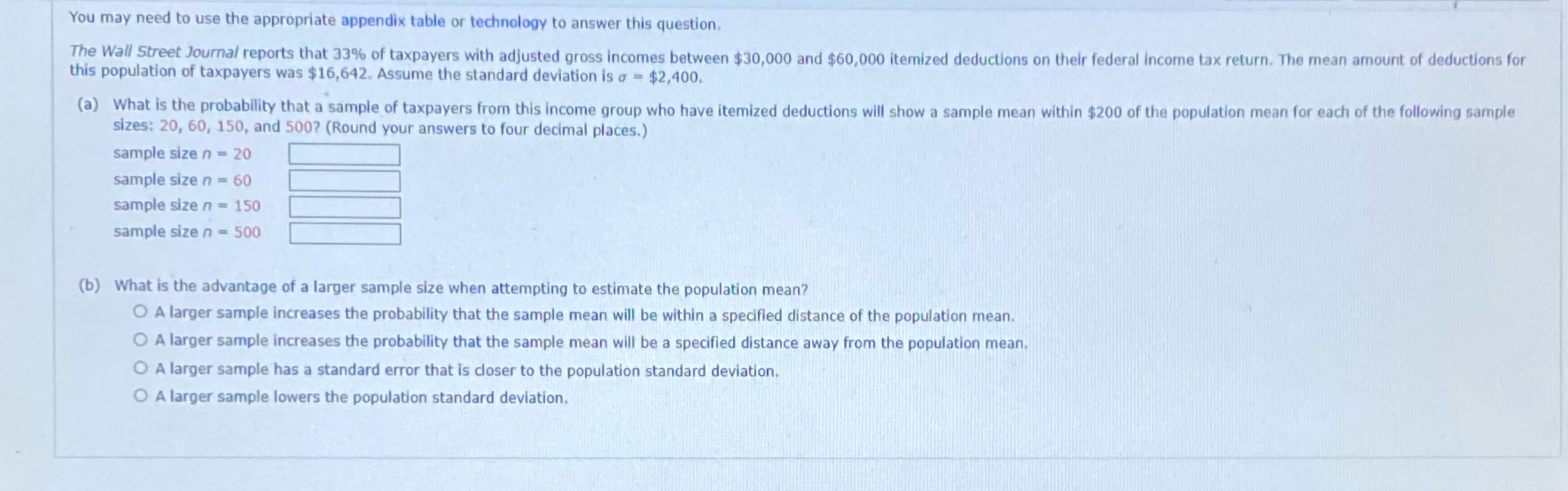

You may need to use the appropriate appendix table or technology to answer this question. The Wall Street Journal reports that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal Income tax return. The mean amount of deductions for this population of taxpayers was $16,642. Assume the standard deviation is a = $2,400. (a) What is the probability that a sample of taxpayers from this income group who have itemized deductions will show a sample mean within $200 of the population mean for each of the following sample sizes: 20, 60, 150, and 500? (Round your answers to four decimal places.) sample size n = 20 sample size n = 60 sample size n = 150 sample size n = 500 (b) What is the advantage of a larger sample size when attempting to estimate the population mean? O A larger sample increases the probability that the sample mean will be within a specified distance of the population mean. O A larger sample increases the probability that the sample mean will be a specified distance away from the population mean. O A larger sample has a standard error that is closer to the population standard deviation. O A larger sample lowers the population standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts