Question: You may use Excel or other spreadsheet software to answer this question. However, you should write out the general formulas that you use to

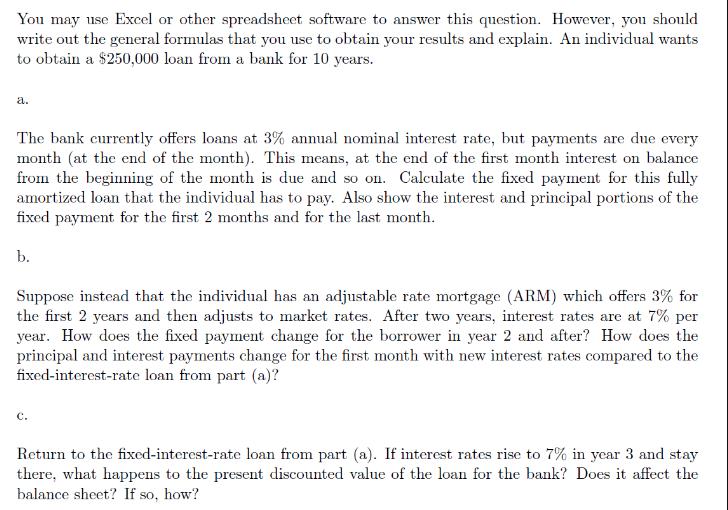

You may use Excel or other spreadsheet software to answer this question. However, you should write out the general formulas that you use to obtain your results and explain. An individual wants to obtain a $250,000 loan from a bank for 10 years. a. The bank currently offers loans at 3% annual nominal interest rate, but payments are due every month (at the end of the month). This means, at the end of the first month interest on balance from the beginning of the month is due and so on. Calculate the fixed payment for this fully amortized loan that the individual has to pay. Also show the interest and principal portions of the fixed payment for the first 2 months and for the last month. b. Suppose instead that the individual has an adjustable rate mortgage (ARM) which offers 3% for the first 2 years and then adjusts to market rates. After two years, interest rates are at 7% per year. How does the fixed payment change for the borrower in year 2 and after? How does the principal and interest payments change for the first month with new interest rates compared to the fixed-interest-rate loan from part (a)? C. Return to the fixed-interest-rate loan from part (a). If interest rates rise to 7% in year 3 and stay there, what happens to the present discounted value of the loan for the bank? Does it affect the balance sheet? If so, how?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts