Question: You may use Excel, the Assignment 2-A Spreadsheet, the textbook and the course material to calculate the problems on this quiz. There is no partial

You may use Excel, the Assignment 2-A Spreadsheet, the textbook and the course material to calculate the problems on this quiz. There is no partial credit, so be very careful in entering your answers and formulas. If you are not sure about something, take the time to go look it up. Please respond to all value questions with precision to the nearest penny, and interest rates to the nearest basis point. If we add one basis point to an interest rate of 12.34% it becomes 12.35%.

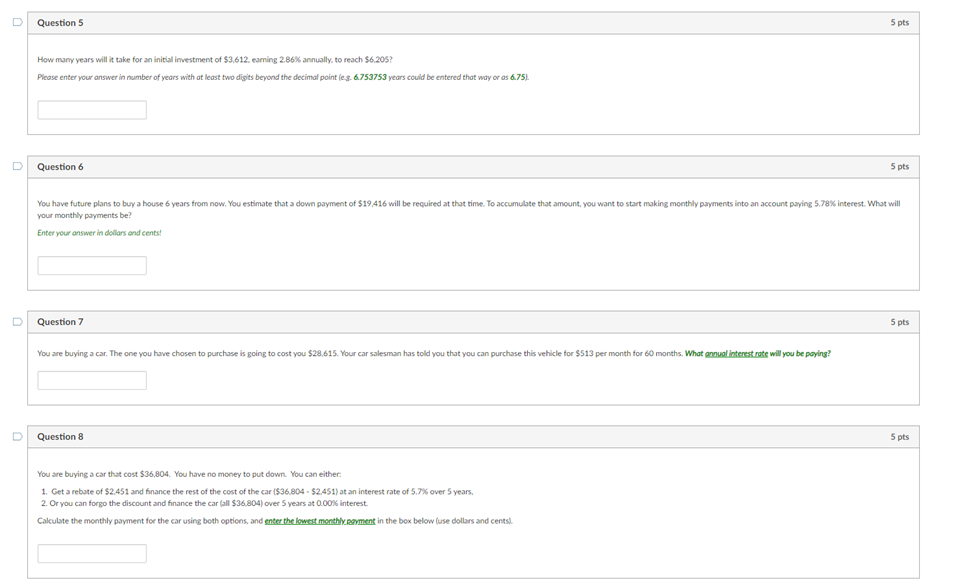

Question 5 5 pts How many years will it take for an initial investment of $3.612 caring 2.86% annually. to reach $6.205? Please enter your answer in number of years with at least two digits beyond the decimal point les 6.753753 years could be entered that way or as 6.751 D Question 6 5 pts You have future plans to buy a house 6 years from now. You estimate that a down payment of $19.416 will be required at that time. To accumulate that amount you want to start making monthly payments into an account paying 5.78% interest. What will your monthly payments be? Enter your answer in dollars and cents! Question 7 5 pts You are buying a car. The one you have chosen to purchase is going to cost you $28,615. Your car salesman has told you that you can purchase this vehicle for $513 per month for 60 months. What annual interest rate will you be paying? D Question 8 5 pts You are buying a car that cost $36,804. You have no money to put down. You can either 1. Get a rebate of $2.451 and finance the rest of the cost of the car ($36.804 - $2.451) at an interest rate of 5.7% over 5 years, 2. Or you can forgo the discount and finance the car (all $36.804) over 5 years at 0.00% interest. Calculate the monthly payment for the car using both options, and enter the lowest monthly payment in the box below (use dollars and cents). Question 5 5 pts How many years will it take for an initial investment of $3.612 caring 2.86% annually. to reach $6.205? Please enter your answer in number of years with at least two digits beyond the decimal point les 6.753753 years could be entered that way or as 6.751 D Question 6 5 pts You have future plans to buy a house 6 years from now. You estimate that a down payment of $19.416 will be required at that time. To accumulate that amount you want to start making monthly payments into an account paying 5.78% interest. What will your monthly payments be? Enter your answer in dollars and cents! Question 7 5 pts You are buying a car. The one you have chosen to purchase is going to cost you $28,615. Your car salesman has told you that you can purchase this vehicle for $513 per month for 60 months. What annual interest rate will you be paying? D Question 8 5 pts You are buying a car that cost $36,804. You have no money to put down. You can either 1. Get a rebate of $2.451 and finance the rest of the cost of the car ($36.804 - $2.451) at an interest rate of 5.7% over 5 years, 2. Or you can forgo the discount and finance the car (all $36.804) over 5 years at 0.00% interest. Calculate the monthly payment for the car using both options, and enter the lowest monthly payment in the box below (use dollars and cents)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts