Question: You may use the attached spreadsheet to help you complete this activity, but you are not required to do so. You will find the spreadsheet

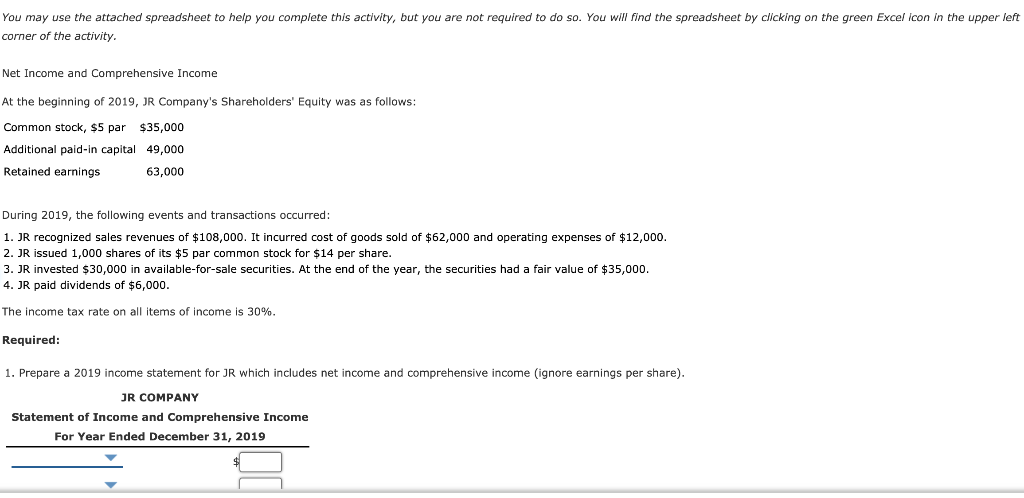

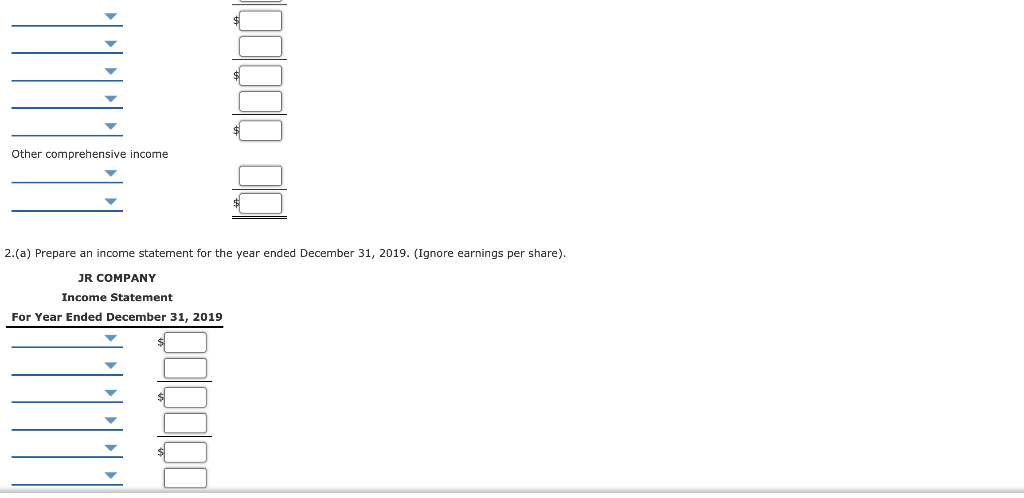

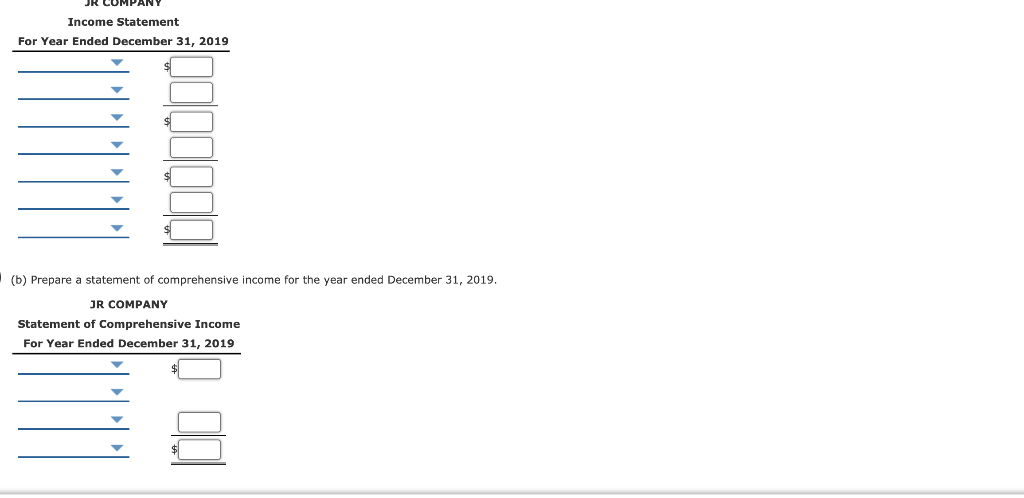

You may use the attached spreadsheet to help you complete this activity, but you are not required to do so. You will find the spreadsheet by clicking on the green Excel icon in the upper left corner of the activity. Net Income and Comprehensive Income At the beginning of 2019, JR Company's Shareholders' Equity was as follows: Common stock, $5 par $35,000 Additional paid-in capital 49,000 Retained earnings 63,000 During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of $108,000. It incurred cost of goods sold of $62,000 and operating expenses of $12,000. 2. JR issued 1,000 shares of its $5 par common stock for $14 per share. 3. JR invested $30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of $35,000. 4. JR paid dividends of $6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income (ignore earnings per share). JR COMPANY Statement of Income and comprehensive Income For Year Ended December 31, 2019 0000000 Other comprehensive income 2.(a) Prepare an income statement for the year ended December 31, 2019. (Ignore earnings per share). JR COMPANY Income Statement For Year Ended December 31, 2019 Income Statement For Year Ended December 31, 2019 (b) Prepare a statement of comprehensive income for the year ended December 31, 2019. JR COMPANY Statement of Comprehensive Income For Year Ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts