Question: You must answer Question 1. Question 1 a) Why do firms closely monitor the price at which their shares and bonds trade in the secondary

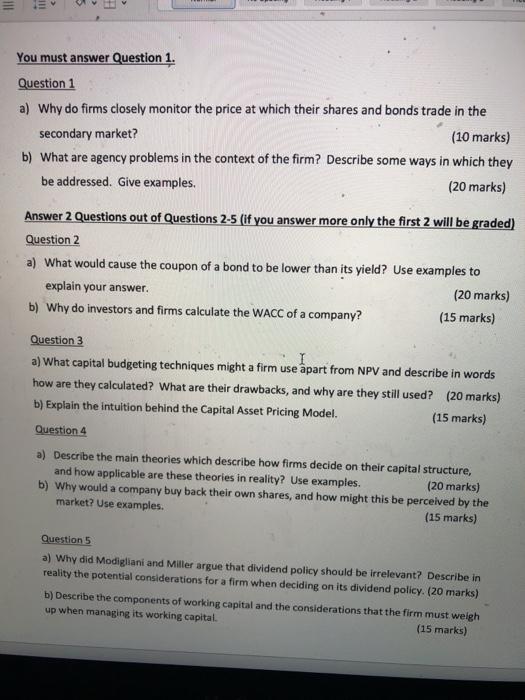

You must answer Question 1. Question 1 a) Why do firms closely monitor the price at which their shares and bonds trade in the secondary market? (10 marks) b) What are agency problems in the context of the firm? Describe some ways in which they be addressed. Give examples. (20 marks) Answer 2 Questions out of Questions 2-5 (If you answer more only the first 2 will be graded) Question 2 a) What would cause the coupon of a bond to be lower than its yield? Use examples to explain your answer. (20 marks) b) Why do investors and firms calculate the WACC of a company? (15 marks) Question 3 a) What capital budgeting techniques might a firm use apart from NPV and describe in words how are they calculated? What are their drawbacks, and why are they still used? (20 marks) b) Explain the intuition behind the Capital Asset Pricing Model. (15 marks) Question 4 a) Describe the main theories which describe how firms decide on their capital structure, and how applicable are these theories in reality? Use examples. (20 marks) b) Why would a company buy back their own shares, and how might this be perceived by the market? Use examples. (15 marks) Question 5 a) Why did Modigliani and Miller argue that dividend policy should be irrelevant? Describe in reality the potential considerations for a firm when deciding on its dividend policy. (20 marks) b) Describe the components of working capital and the considerations that the firm must weigh up when managing its working capital (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts