Question: You need to show/write/explain inputs to your computations to get full credit. For each of the questions below, draw the time line where needed. Show

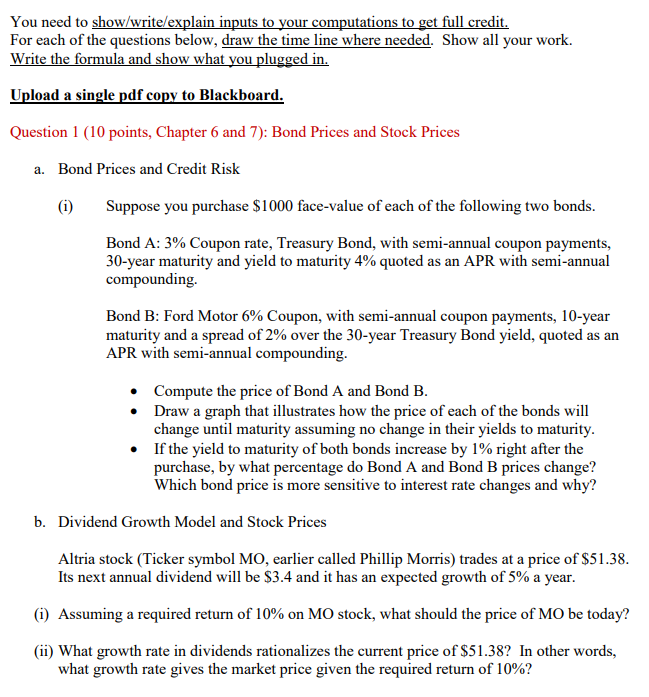

You need to show/write/explain inputs to your computations to get full credit. For each of the questions below, draw the time line where needed. Show all your work. Write the formula and show what you plugged in. Upload a single pdf copy to Blackboard. Question 1 (10 points, Chapter 6 and 7): Bond Prices and Stock Prices a. Bond Prices and Credit Risk (i) Suppose you purchase $1000 face-value of each of the following two bonds. Bond A: 3% Coupon rate, Treasury Bond, with semi-annual coupon payments, 30-year maturity and yield to maturity 4% quoted as an APR with semi-annual compounding. Bond B: Ford Motor 6% Coupon, with semi-annual coupon payments, 10-year maturity and a spread of 2% over the 30-year Treasury Bond yield, quoted as an APR with semi-annual compounding. Compute the price of Bond A and Bond B. Draw a graph that illustrates how the price of each of the bonds will change until maturity assuming no change in their yields to maturity. If the yield to maturity of both bonds increase by 1% right after the purchase, by what percentage do Bond A and Bond B prices change? Which bond price is more sensitive to interest rate changes and why? b. Dividend Growth Model and Stock Prices Altria stock (Ticker symbol MO, earlier called Phillip Morris) trades at a price of $51.38. Its next annual dividend will be $3.4 and it has an expected growth of 5% a year. (1) Assuming a required return of 10% on MO stock, what should the price of MO be today? (ii) What growth rate in dividends rationalizes the current price of $51.38? In other words, what growth rate gives the market price given the required return of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts