Question: You need to show/write/explain inputs to your computations to get full credit. For each of the questions below, draw the time line where needed. Show

You need to show/write/explain inputs to your computations to get full credit. For each of the questions below, draw the time line where needed. Show all your work. Write the formula and show what you plugged in.

Question 1.

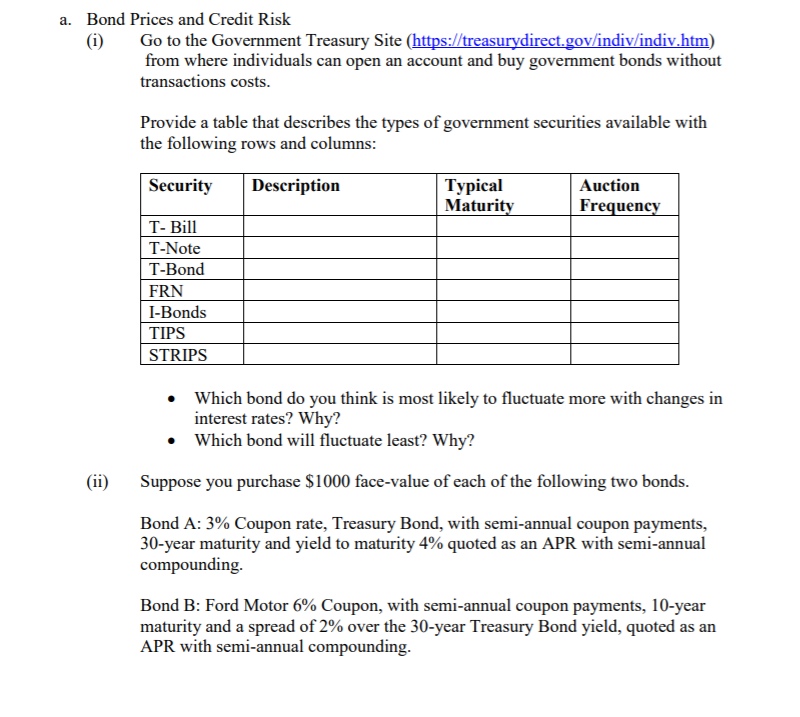

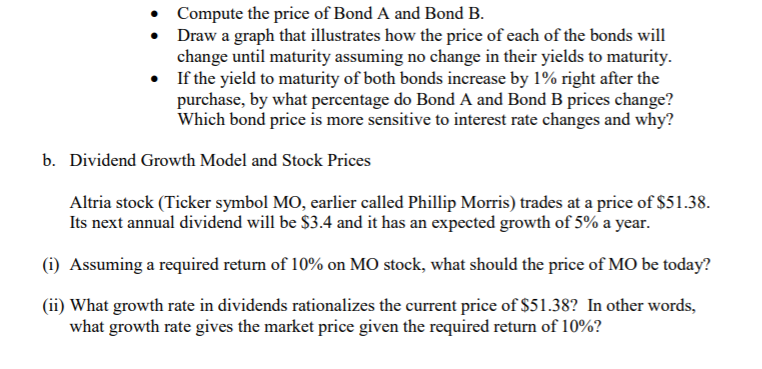

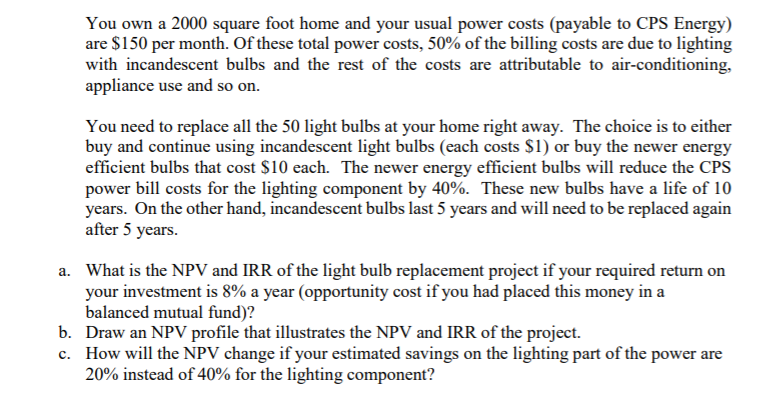

a. Bond Prices and Credit Risk (i) Go to the Government Treasury Site (https://treasurydirect.gov/indiv/indiv.htm) from where individuals can open an account and buy government bonds without transactions costs. Provide a table that describes the types of government securities available with the following rows and columns: Security Description Typical Auction Maturity Frequency T- Bill T-Note T-Bond FRN I-Bonds TIPS STRIPS . Which bond do you think is most likely to fluctuate more with changes in interest rates? Why? . Which bond will fluctuate least? Why? (ii) Suppose you purchase $1000 face-value of each of the following two bonds. Bond A: 3% Coupon rate, Treasury Bond, with semi-annual coupon payments, 30-year maturity and yield to maturity 4% quoted as an APR with semi-annual compounding. Bond B: Ford Motor 6% Coupon, with semi-annual coupon payments, 10-year maturity and a spread of 2% over the 30-year Treasury Bond yield, quoted as an APR with semi-annual compounding.0 Compute the price of Bond A and Bond B. 0 Draw a graph that illustrates how the price of each of the bonds will change until maturity assuming no change in their yields to maturity. I Ifthe yield to maturity of both bonds increase by 1% right after the purchase, by what percentage do Bond A and Bond B prices change? Which bond price is more sensitive to interest rate changes and why? b. Dividend Growth Model and Stock Prices Altria stock (Ticker symbol MO, earlier called Phillip Morris) trades at a price of$51.33. Its next annual dividend will be 53.4 and it has an expected growth of 5% a year. (i) Assuming a required return of 10% on MO stock, what should the price of MD be today? (ii) What growth rate in dividends rationalizes the current price of$51.33? In other words, what growth rate gives the market price given the required return of 10%? You own a 2000 square foot home and your usual power cosE (payable to CPS Energy) are $150 per month. Of these total power costs, 50% of the billing costs are due to lighting with incandescent bulbs and the rest of the costs are attributable to air-conditioning, appliance use and so on. You need to replace all the 50 light bulbs at your home light away. The choice is to eitha' buy and continue using incandescent light bulbs (each costs $1) or buy the newer energy efcient bulbs that cost $10 each. The newer energy efcient bulbs will reduce the CPS power bill costs for the lighting component by 40%. These new bulbs have a life of 10 years. On the other hand, incandescent bulbs last 5 years and will need to be replaced again aer 5 years. What is the NPV and [RR of the light bulb replacement project if your required return on your investment is 3% a year (opportunity cost if you had placed this money in a balanced mutual fund)? b. Draw an NPV prole that illustrates the NPV and [RR of the project. 8. How will the NPV change if your estimated savings on the lighting part of the power are 20% instead of40% for the lighting component? \foffering seven months ago. But Merck is planning to take over the fledgling company for $60 per share. That represents a roughly 130% premium to the IPO stock's share price, SVB Leerink analyst Geoffrey Porges said in a report to clients." a. Provide a graph of the stock price of PAND from Feb 215 to Feb 28" using Finance.yahoo.com b. Describe in 5 lines or less how the stock price changed? Why? c. What is the efficient market hypothesis? What does the price reaction of PAND imply about market efficiency? Could traders have exploited the published news to make a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts