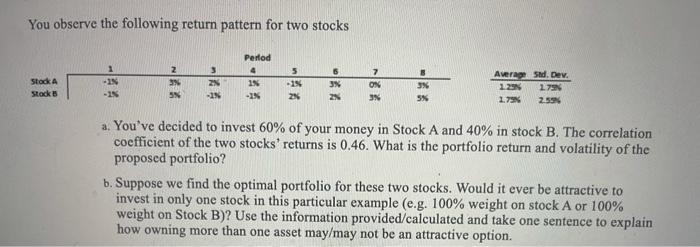

Question: You observe the following return pattern for two stocks 1 -15 -25 Stock A Stock 2 3 SN Perfod 4 IN 3 2x - 5

You observe the following return pattern for two stocks 1 -15 -25 Stock A Stock 2 3 SN Perfod 4 IN 3 2x - 5 -15 2N 6 3X ZN 7 ON 3% 9% 5% Average Std. Dev. 1.25 179 1.79% 255 -1 a. You've decided to invest 60% of your money in Stock A and 40% in stock B. The correlation coefficient of the two stocks' returns is 0.46. What is the portfolio return and volatility of the proposed portfolio? b. Suppose we find the optimal portfolio for these two stocks. Would it ever be attractive to invest in only one stock in this particular example (e.g. 100% weight on stock A or 100% weight on Stock B)? Use the information provided/calculated and take one sentence to explain how owning more than one asset may/may not be an attractive option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts