Question: You only need to answer Question 3 . DO NOT USE EXCEL! You are considering the purchase of a machine with an expected life of

You only need to answer Question 3. DO NOT USE EXCEL!

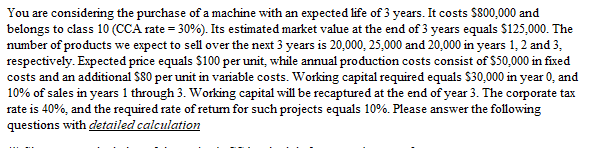

You are considering the purchase of a machine with an expected life of 3 years. It costs $800,000 and belongs to class 10(CCA rate =30% ). Its estimated market value at the end of 3 years equals $125,000. The number of products we expect to sell over the next 3 years is 20,000,25,000 and 20,000 in years 1,2 and 3 , respectively. Expected price equals $100 per unit, while annual production costs consist of $50,000 in fixed costs and an additional $80 per unit in variable costs. Working capital required equals $30,000 in year 0 , and 10% of sales in years 1 through 3 . Working capital will be recaptured at the end of year 3 . The corporate tax rate is 40%, and the required rate of return for such projects equals 10%. Please answer the following questions with detailed calculation (1) Show your calculation of the project's CCA schedule from year 1 to year 3 . (2) What are the net working capital and changes in net working capital for year 0 to year 3 ? (3) What are the incremental cash flows of this project in year 0 , year 1 , year 2 , and year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts