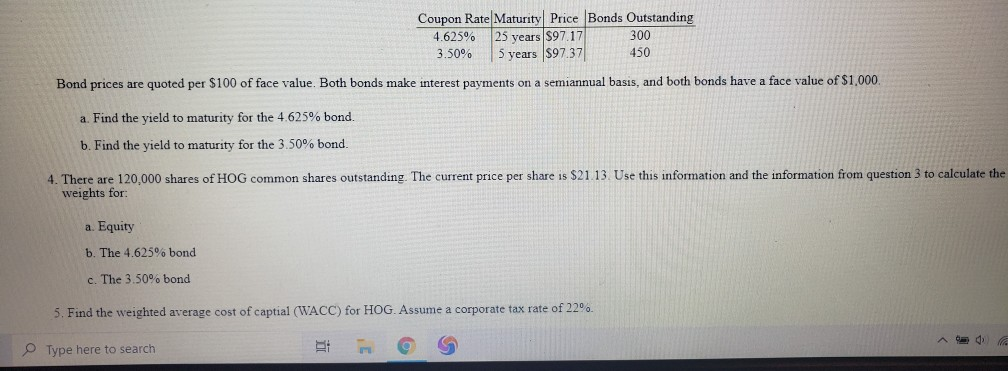

Question: You only need to answer Question 4. please use excel and show work Coupon Rate Maturity Price Bonds Outstanding 4.625% 25 years $97.17 300 3.50%

You only need to answer Question 4. please use excel and show work

Coupon Rate Maturity Price Bonds Outstanding 4.625% 25 years $97.17 300 3.50% 5 years $9737 4 50 Bond prices are quoted per $100 of face value. Both bonds make interest payments on a semiannual basis, and both bonds have a face value of $1,000. a. Find the yield to maturity for the 4.625% bond. b. Find the yield to maturity for the 3.50% bond. 4. There are 120,000 shares of HOG common shares outstanding. The current price per share is $21.13. Use this information and the information from question 3 to calculate the weights for: a. Equity b. The 4.625% bond c. The 3.50% bond 5. Find the weighted average cost of captial (WACC) for HOG. Assume a corporate tax rate of 22% Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts