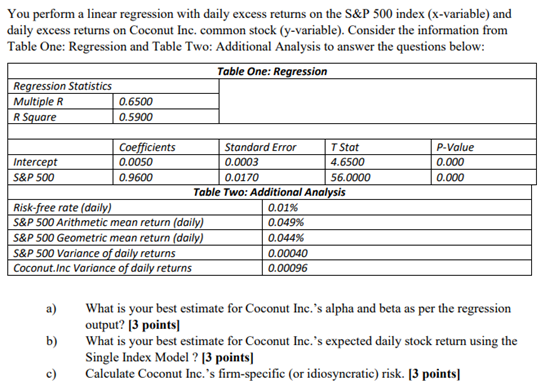

Question: You perform a linear regression with daily excess returns on the S&P 500 index (x-variable) and daily excess returns on Coconut Inc. common stock (y-variable).

You perform a linear regression with daily excess returns on the S&P 500 index (x-variable) and daily excess returns on Coconut Inc. common stock (y-variable). Consider the information from Table One: Regression and Table Two: Additional Analysis to answer the questions below: Table One: Regression Regression Statistics Multiple R 0.6500 R Square 0.5900 P-Value 0.000 0.000 Coefficients Standard Error T Stat Intercept 0.0050 0.0003 4.6500 S&P 500 0.9600 0.0170 56.0000 Table Two: Additional Analysis Risk-free rate (daily) 0.01% S&P 500 Arithmetic mean return (daily) 0.049% S&P 500 Geometric mean return (daily) 0.044% S&P 500 Variance of daily returns 0.00040 Coconut.inc Variance of daily returns 0.00096 a) b) What is your best estimate for Coconut Inc.'s alpha and beta as per the regression output? [3 points) What is your best estimate for Coconut Inc.'s expected daily stock return using the Single Index Model ? [3 points Calculate Coconut Inc.'s firm-specific (or idiosyncratic) risk. [3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts