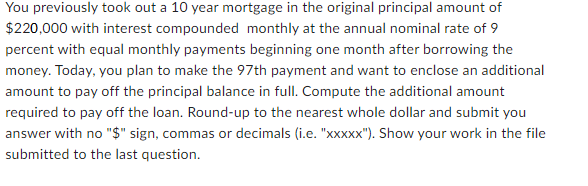

Question: You previously took out a 10 year mortgage in the original principal amount of $220,000 with interest compounded monthly at the annual nominal rate

You previously took out a 10 year mortgage in the original principal amount of $220,000 with interest compounded monthly at the annual nominal rate of 9 percent with equal monthly payments beginning one month after borrowing the money. Today, you plan to make the 97th payment and want to enclose an additional amount to pay off the principal balance in full. Compute the additional amount required to pay off the loan. Round-up to the nearest whole dollar and submit you answer with no "$" sign, commas or decimals (i.e. "xxxxx"). Show your work in the file submitted to the last question.

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

To find the additional amount required to pay off the loan we need to calculate the remaining princi... View full answer

Get step-by-step solutions from verified subject matter experts