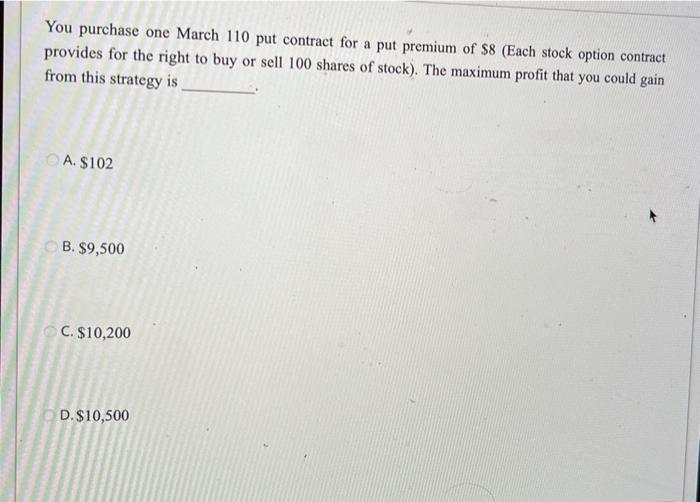

Question: You purchase one March 110 put contract for a put premium of $8 (Each stock option contract provides for the right to buy or sell

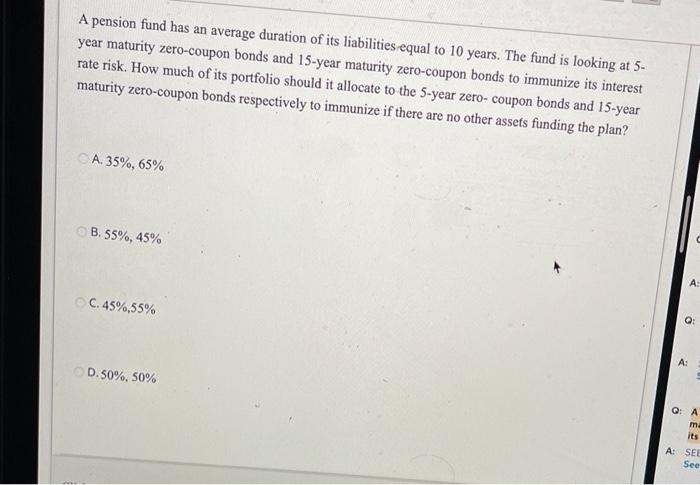

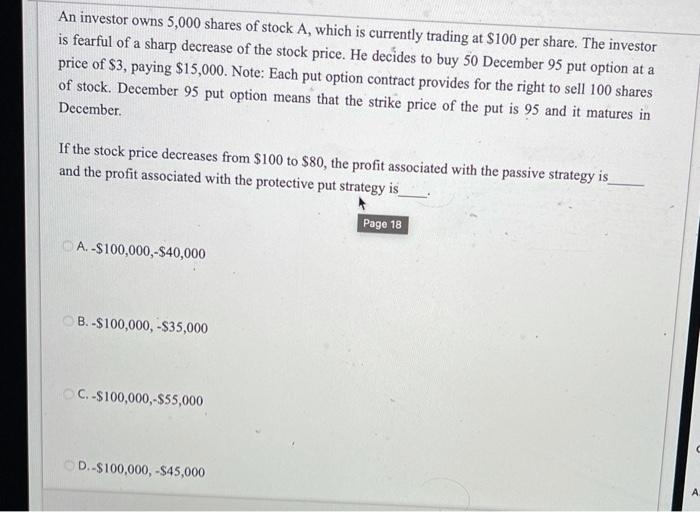

You purchase one March 110 put contract for a put premium of $8 (Each stock option contract provides for the right to buy or sell 100 shares of stock). The maximum profit that you could gain from this strategy is A $102 B. $9,500 C. $10,200 D. $10,500 A pension fund has an average duration of its liabilities equal to 10 years. The fund is looking at 5. year maturity zero-coupon bonds and 15-year maturity zero-coupon bonds to immunize its interest rate risk. How much of its portfolio should it allocate to the 5-year zero-coupon bonds and 15-year maturity zero-coupon bonds respectively to immunize if there are no other assets funding the plan? A. 35%, 65% B. 55%, 45% C A: C. 45%,55% A: D. 50%, 50% O me its A: SEE See An investor owns 5,000 shares of stock A, which is currently trading at $100 per share. The investor is fearful of a sharp decrease of the stock price. He decides to buy 50 December 95 put option at a price of $3, paying $15,000. Note: Each put option contract provides for the right to sell 100 shares of stock. December 95 put option means that the strike price of the put is 95 and it matures in December. If the stock price decreases from $100 to $80, the profit associated with the passive strategy is and the profit associated with the protective put strategy is Page 18 A. -$100,000,-$40,000 B. -$100,000,-$35,000 C. -$100,000,-$55,000 D.-$100,000,-$45,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts