Question: You receive a bank statement dated April 30 that shows a balance of $4564.74. Your checkbook balance, as of June 30, is $1860.24. The

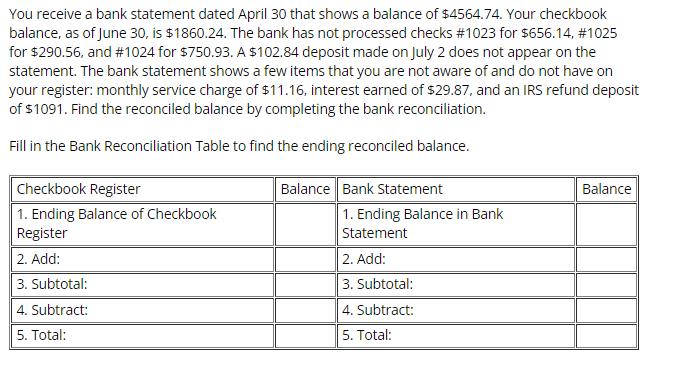

You receive a bank statement dated April 30 that shows a balance of $4564.74. Your checkbook balance, as of June 30, is $1860.24. The bank has not processed checks # 1023 for $656.14, #1025 for $290.56, and #1024 for $750.93. A $102.84 deposit made on July 2 does not appear on the statement. The bank statement shows a few items that you are not aware of and do not have on your register: monthly service charge of $11.16, interest earned of $29.87, and an IRS refund deposit of $1091. Find the reconciled balance by completing the bank reconciliation. Fill in the Bank Reconciliation Table to find the ending reconciled balance. Checkbook Register 1. Ending Balance of Checkbook Register 2. Add: 3. Subtotal: 4. Subtract: 5. Total: Balance Bank Statement 1. Ending Balance in Bank Statement 2. Add: 3. Subtotal: 4. Subtract: 5. Total: Balance

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Sure Heres how to fill out the Bank Reconciliation Table Checkbook Register 1 Ending Bal... View full answer

Get step-by-step solutions from verified subject matter experts