Question: You received partial credit in the previous attempt. View previous att A finance lease agreement calls for quarterly lease payments of $6,686 over a

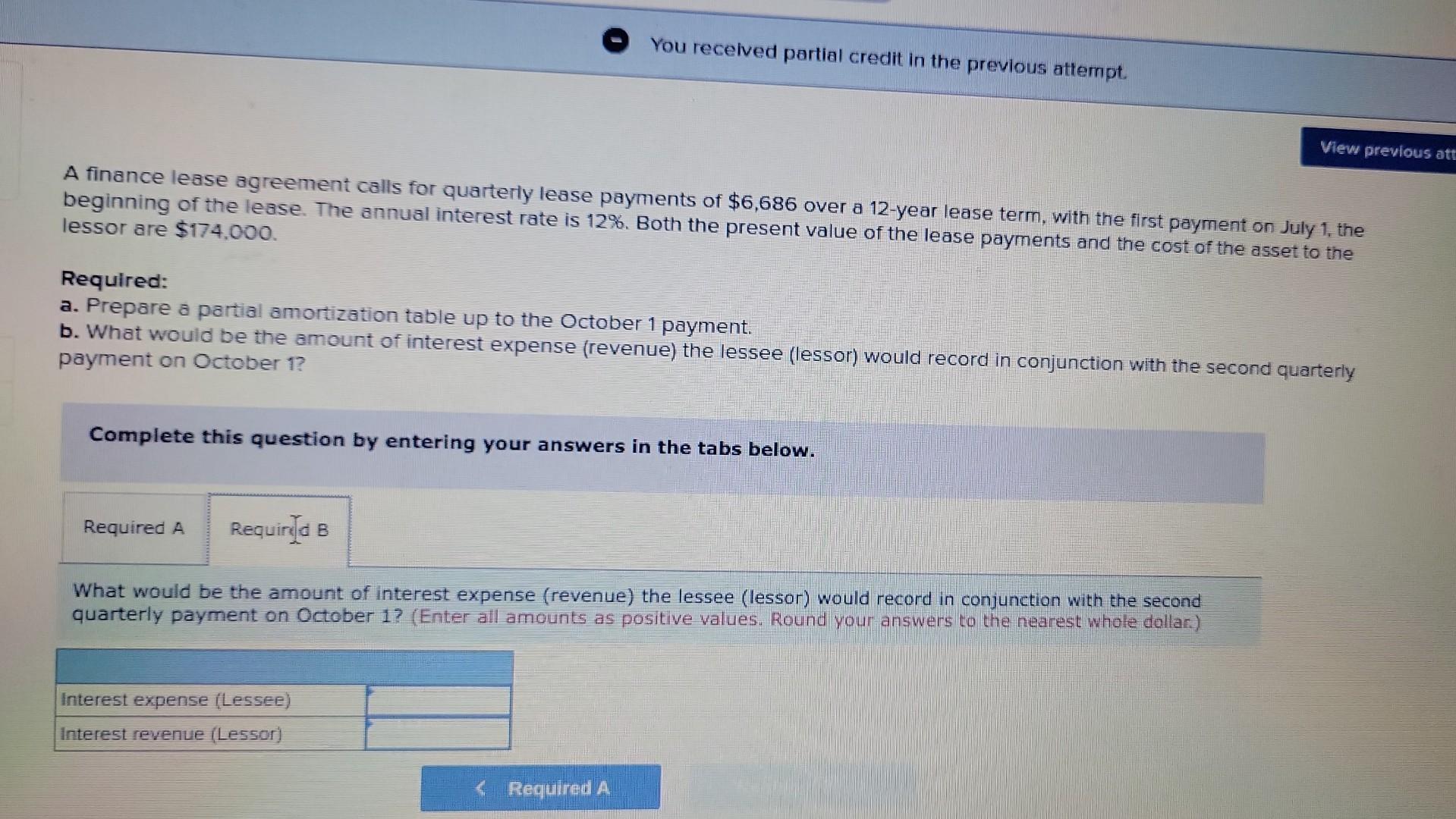

You received partial credit in the previous attempt. View previous att A finance lease agreement calls for quarterly lease payments of $6,686 over a 12-year lease term, with the first payment on July 1, the beginning of the lease. The annual interest rate is 12%. Both the present value of the lease payments and the cost of the asset to the lessor are $174,000. Required: a. Prepare a partial amortization table up to the October 1 payment. b. What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1? Complete this question by entering your answers in the tabs below. Required A Required B What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1? (Enter all amounts as positive values. Round your answers to the nearest whole dollar.) Interest expense (Lessee) Interest revenue (Lessor)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts