Question: You recently accepted an assignment with Commitment Limited as a financial consultant. One of your first assignments is the analysis of two proposed capital investment

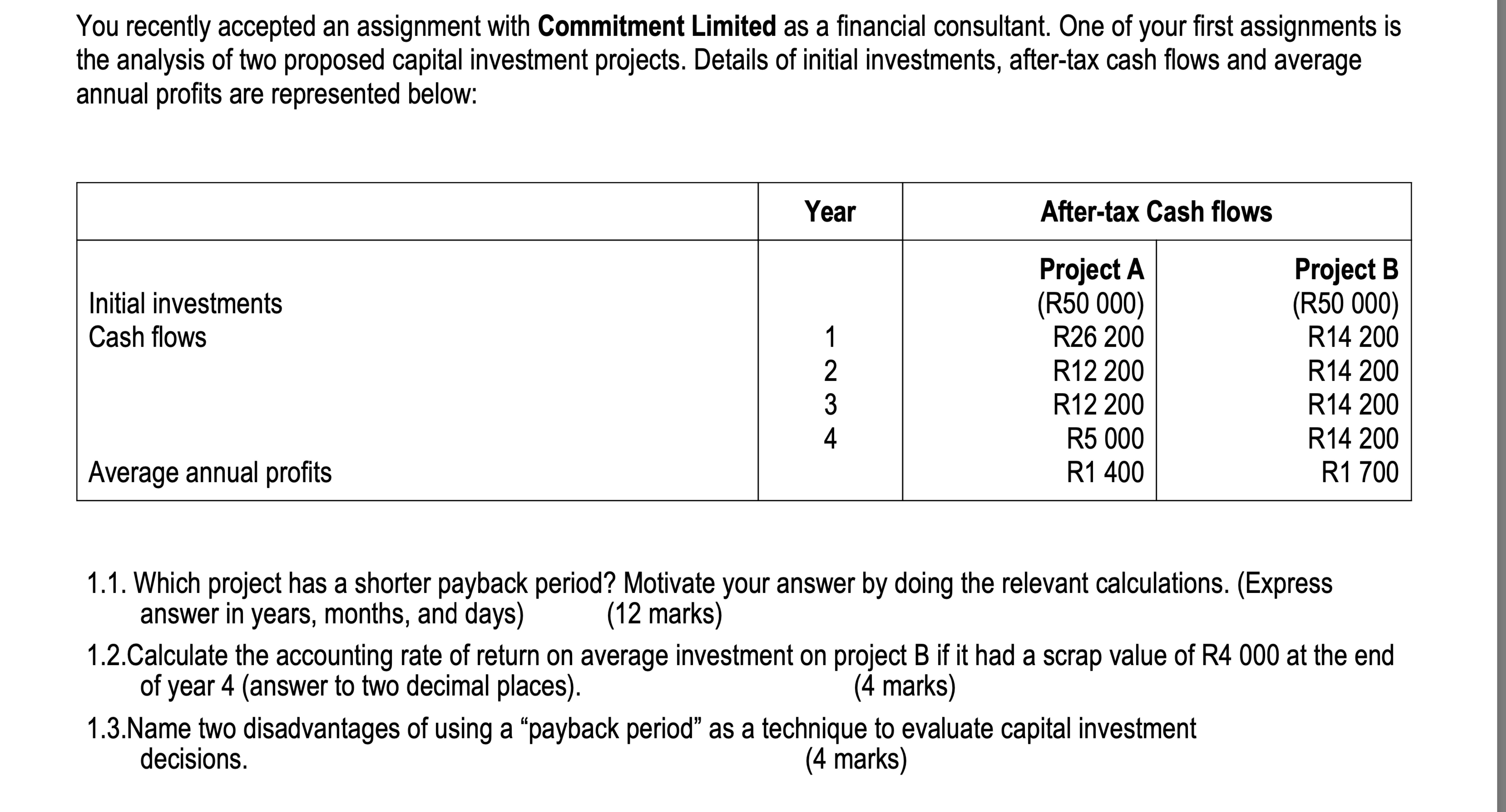

You recently accepted an assignment with Commitment Limited as a financial consultant. One of your first assignments is the analysis of two proposed capital investment projects. Details of initial investments, aftertax cash flows and average annual profits are represented below:

tableYear,Aftertax Cash flowsProject AProject BInitial investments,,RRCash flows,RRRRRRAverage annual profits,RR

Which project has a shorter payback period? Motivate your answer by doing the relevant calculations. Express answer in years, months, and days marks

Calculate the accounting rate of return on average investment on project if it had a scrap value of at the end of year answer to two decimal places

marks

Name two disadvantages of using a "payback period" as a technique to evaluate capital investment decisions.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock