Question: 8. In a 1988 article, Josef Brada and Ronald Graves built an interesting model of defense spending in the Soviet Union just before the

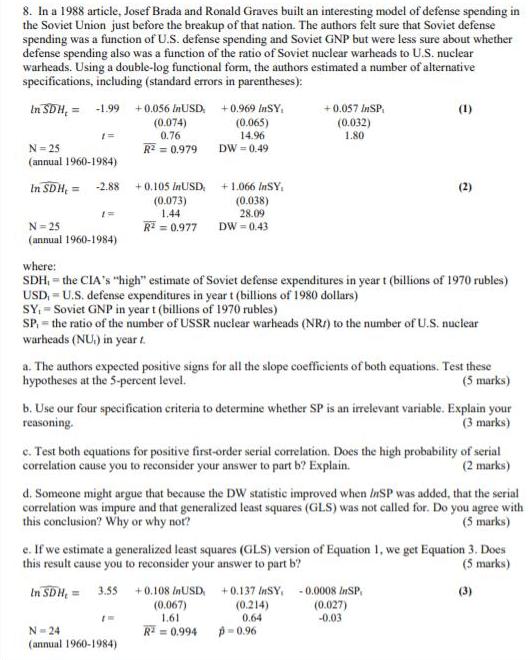

8. In a 1988 article, Josef Brada and Ronald Graves built an interesting model of defense spending in the Soviet Union just before the breakup of that nation. The authors felt sure that Soviet defense spending was a function of U.S. defense spending and Soviet GNP but were less sure about whether defense spending also was a function of the ratio of Soviet nuclear warheads to U.S. nuclear warheads. Using a double-log functional form, the authors estimated a number of alternative specifications, including (standard errors in parentheses): +0.056 InUSD. +0.969 INSY. (0.074) 0.76 In SDH, = -1.99 +0.057 INSP. (1) (0.065) 14.96 (0.032) 1.80 N= 25 R2 = 0.979 DW = 0.49 (annual 1960-1984) In SDH, = -2.88 + 0.105 InUSD, +1.066 INSY. (2) (0.073) 1.44 R = 0.977 (0.038) 28.09 DW = 0.43 N= 25 (annual 1960-1984) where: SDH, = the CIA's "high" estimate of Soviet defense expenditures in year t (billions of 1970 rubles) USD, = U.S. defense expenditures in year t (billions of 1980 dollars) SY: = Soviet GNP in year t (billions of 1970 rubles) SP, = the ratio of the number of USSR nuclear warheads (NR1) to the number of U.S. nuclear warheads (NU) in year t. a. The authors expected positive signs for all the slope coefficients of both equations. Test these hypotheses at the 5-percent level. (5 marks) b. Use our four specification criteria to determine whether SP is an irelevant variable. Explain your reasoning. (3 marks) c. Test both equations for positive first-order serial correlation. Does the high probability of serial correlation cause you to reconsider your answer to part b? Explain. (2 marks) d. Someone might argue that because the DW statistic improved when InSP was added, that the serial correlation was impure and that generalized least squares (GLS) was not called for. Do you agree with this conclusion? Why or why not? (5 marks) e. If we estimate a generalized least squares (GLS) version of Equation 1, we get Equation 3. Does this result cause you to reconsider your answer to part b? (5 marks) = 3.55 +0.108s InUSD, +0.137 InSY, -0.0008 InSP, (0.214) 0.64 In SDH, = (3) (0.067) (0.027) -0.03 1.61 N-24 R = 0.994 p- 0.96 (annual 1960-1984)

Step by Step Solution

3.26 Rating (144 Votes )

There are 3 Steps involved in it

utrreltin is the rreltin urring between the tw errr terms Here sine they re nsidering fr the test f ... View full answer

Get step-by-step solutions from verified subject matter experts