Question: You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Because the beneficiaries of the trust, like virtually

You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Because the beneficiaries of the trust, like virtually everyone, are risk averse, the riskiness of each alternative is an important aspect of the decision. One possible measure of risk is the standard deviation of returns. (1) Calculate this value for each alternative, and fill in the row for ? in the table. (2) What type of risk does the standard deviation measure?

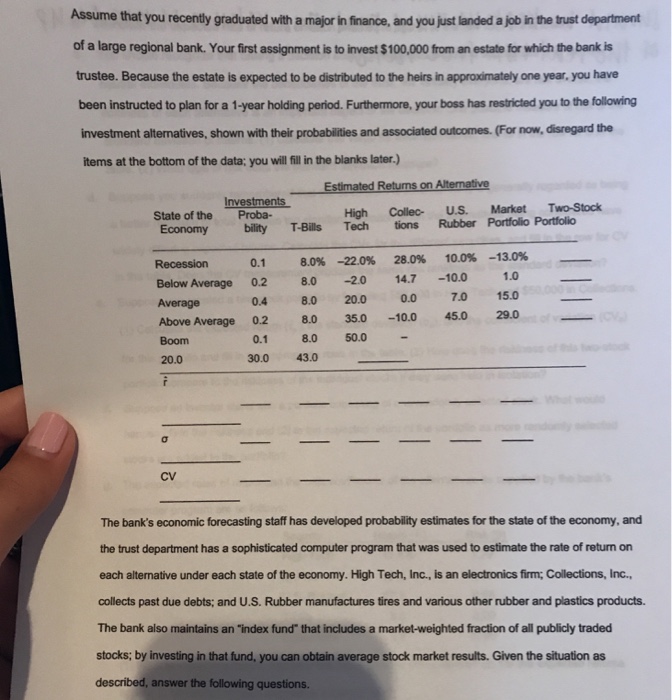

Assume that you recently graduated with a major in finance, and you just landed a job in the trust department of a large regional bank. Your first assignment is to invest $100,000 from an estate for which the bank is trustee. Because the estate is expected to be distributed to the heirs in approximately one year, you have been instructed to plan for a 1-year holding period. Furthermore, your boss has restricted you to the following investment alternatives, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data: you will fll in the blanks later.) Estimated Returns on Alternative Proba- High Collec U.S. Market Two-Stock State of the Economybility T-Bils Tech tions Rubber Portfolio Portfolio -13.0% 1.0 Recession 0.1 8.0% -22.0% 28.0% 10.0% Below Average 0.2 8.0 -20 147 -10.0 Average Above Average 0.2 8.0 35.0-10.0 45.0 29.0 Boom 20.0 0.4 8.0 20.00.07.0 150 0.1 8.0 50.0 30.0 43.0 CV The bank's economic forecasting staff has developed probability estimates for the state of the economy, and the trust department has a sophisticated computer program that was used to estimate the rate of return on each alternative under each state of the economy. High Tech, Inc., is an electronics firm; Collections, Inc. collects past due debts; and U.S. Rubber manufactures tires and various other rubber and plastics products. The bank also maintains an "index fund" that includes a market-weighted fraction of all publicly traded stocks; by investing in that fund, you can obtain average stock market results. Given the situation as described, answer the following questions. Assume that you recently graduated with a major in finance, and you just landed a job in the trust department of a large regional bank. Your first assignment is to invest $100,000 from an estate for which the bank is trustee. Because the estate is expected to be distributed to the heirs in approximately one year, you have been instructed to plan for a 1-year holding period. Furthermore, your boss has restricted you to the following investment alternatives, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data: you will fll in the blanks later.) Estimated Returns on Alternative Proba- High Collec U.S. Market Two-Stock State of the Economybility T-Bils Tech tions Rubber Portfolio Portfolio -13.0% 1.0 Recession 0.1 8.0% -22.0% 28.0% 10.0% Below Average 0.2 8.0 -20 147 -10.0 Average Above Average 0.2 8.0 35.0-10.0 45.0 29.0 Boom 20.0 0.4 8.0 20.00.07.0 150 0.1 8.0 50.0 30.0 43.0 CV The bank's economic forecasting staff has developed probability estimates for the state of the economy, and the trust department has a sophisticated computer program that was used to estimate the rate of return on each alternative under each state of the economy. High Tech, Inc., is an electronics firm; Collections, Inc. collects past due debts; and U.S. Rubber manufactures tires and various other rubber and plastics products. The bank also maintains an "index fund" that includes a market-weighted fraction of all publicly traded stocks; by investing in that fund, you can obtain average stock market results. Given the situation as described, answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts