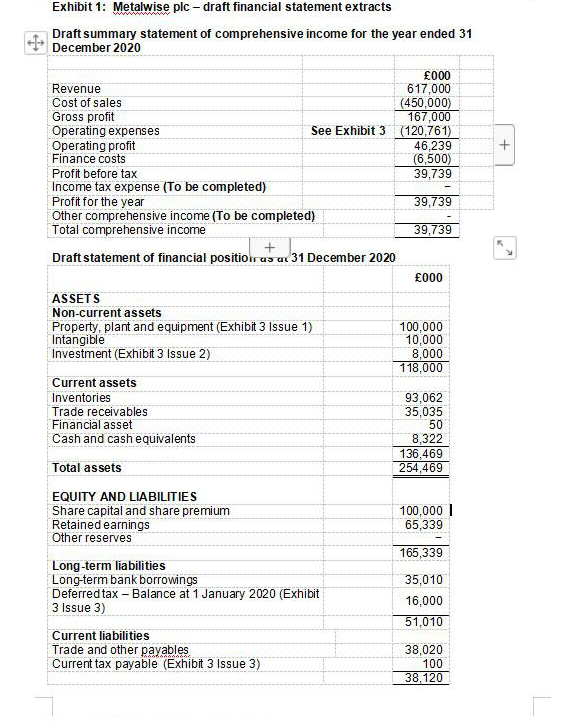

Question: Exhibit 1: Metalwise plc - draft financial statement extracts Draft summary statement of comprehensive income for the year ended 31 December 2020 + 000 Revenue

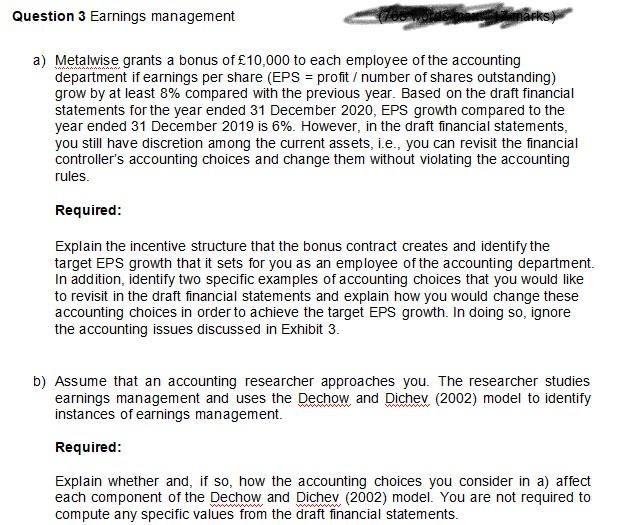

Exhibit 1: Metalwise plc - draft financial statement extracts Draft summary statement of comprehensive income for the year ended 31 December 2020 + 000 Revenue 617,000 Cost of sales (450,000) Gross profit 167,000 Operating expenses See Exhibit 3 (120,761) Operating profit 46,239 Finance costs (6,500) Profit before tax 39.739 Income tax expense (To be completed) Profit for the year 39,739 Other comprehensive income (To be completed) Total comprehensive income 39,739 Draft statement of financial positiolras uz 31 December 2020 000 ASSETS Non-current assets Property, plant and equipment (Exhibit 3 Issue 1) 100,000 Intangible 10,000 Investment (Exhibit 3 Issue 2) 8,000 118,000 Current assets Inventories 93,062 Trade receivables 35,035 Financial asset 50 Cash and cash equivalents 8,322 136,469 Total assets 254,469 EQUITY AND LIABILITIES Share capital and share premium 100,000 Retained earnings 65,339 Other reserves 165,339 Long-term liabilities Long-term bank borrowings 35,010 Deferred tax - Balance at 1 January 2020 (Exhibit 3 Issue 3) 16,000 51,010 Current liabilities Trade and other payables 38,020 Current tax payable (Exhibit 3 Issue 3) 100 38,120 Question 3 Earnings management marks) a) Metalwise grants a bonus of 10,000 to each employee of the accounting department if earnings per share (EPS = profit / number of shares outstanding) grow by at least 8% compared with the previous year. Based on the draft financial statements for the year ended 31 December 2020, EPS growth compared to the year ended 31 December 2019 is 6%. However, in the draft financial statements, you still have discretion among the current assets, i.e., you can revisit the financial controller's accounting choices and change them without violating the accounting rules. Required: Explain the incentive structure that the bonus contract creates and identify the target EPS growth that it sets for you as an employee of the accounting department. In addition, identify two specific examples of accounting choices that you would like to revisit in the draft financial statements and explain how you would change these accounting choices in order to achieve the target EPS growth. In doing so, ignore the accounting issues discussed in Exhibit 3. b) Assume that an accounting researcher approaches you. The researcher studies earnings management and uses the Dechow and Dichev (2002) model to identify instances of earnings management. Required: Explain whether and, if so, how the accounting choices you consider in a) affect each component of the Dechow and Dichev (2002) model. You are not required to compute any specific values from the draft financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts