Question: You should use Excel to solve this. Please give a detailed solution and provide a screenshot of what you did in the excel function. 9.

You should use Excel to solve this. Please give a detailed solution and provide a screenshot of what you did in the excel function.

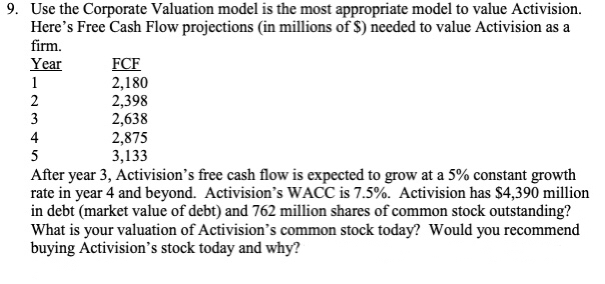

9. Use the Corporate Valuation model is the most appropriate model to value Activision Here's Free Cash Flow projections (in millions of S) needed to value Activision as a firm. Year FCE 2,180 2,398 2,638 2,875 3,133 After year 3, Activision's free cash flow is expected to grow at a 5% constant growth rate in year 4 and beyond. Activision's WACC is 7.5%. Activision has $4,390 million in debt (market value of debt) and 762 million shares of common stock outstanding? What is your valuation of Activision's common stock today? Would you recommend buying Activision's stock today and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts