Question: You source Ice Cubes to sell in the US from an Eskimo village and you owe them DKK 3,000,000 which is due in 60 days.

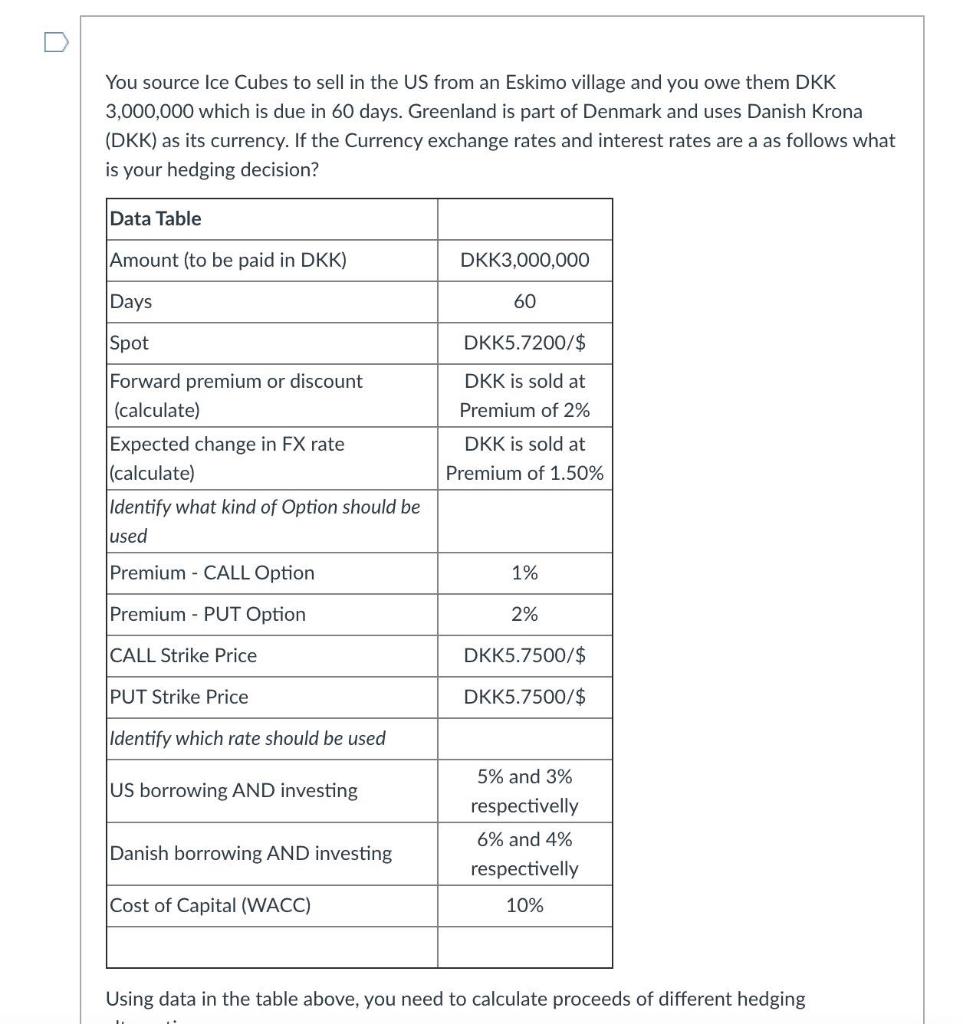

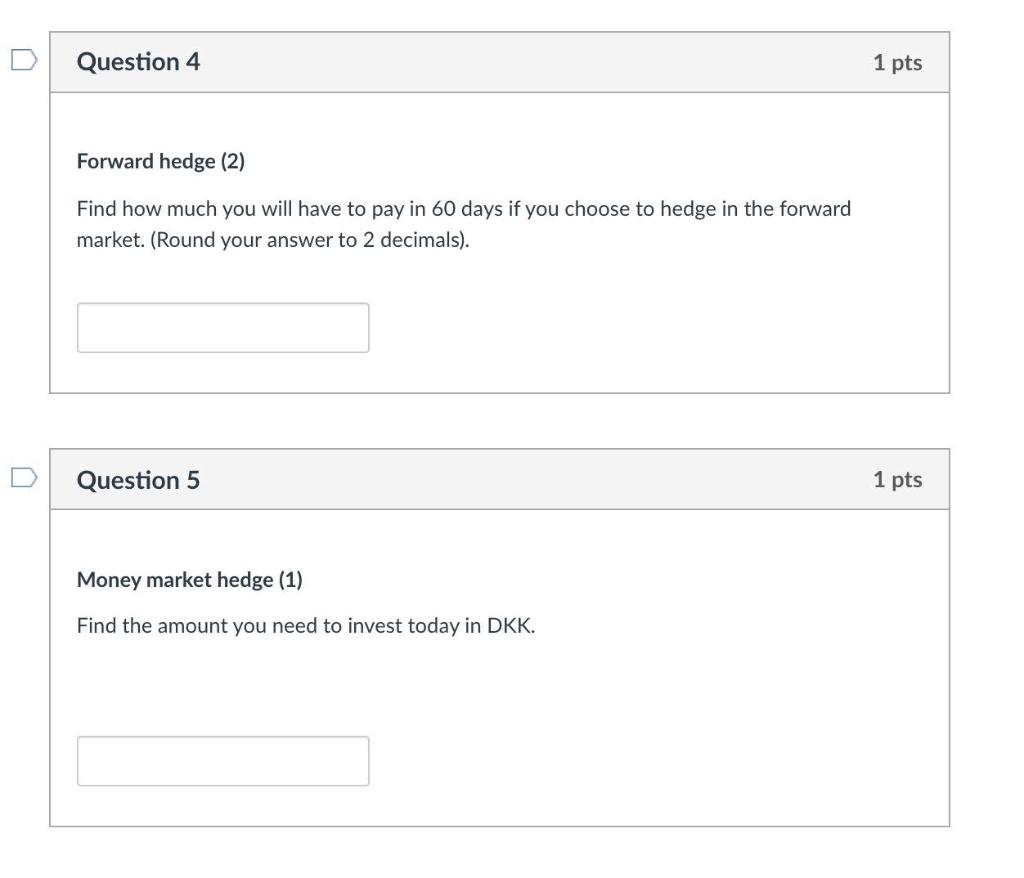

You source Ice Cubes to sell in the US from an Eskimo village and you owe them DKK 3,000,000 which is due in 60 days. Greenland is part of Denmark and uses Danish Krona (DKK) as its currency. If the Currency exchange rates and interest rates are a as follows what is your hedging decision? Data Table Amount (to be paid in DKK) DKK3,000,000 Days 60 Spot DKK5.7200/$ DKK is sold at Premium of 2% Forward premium or discount (calculate) Expected change in FX rate (calculate) Identify what kind of Option should be used DKK is sold at Premium of 1.50% Premium - CALL Option 1% Premium - PUT Option 2% CALL Strike Price DKK5.7500/$ PUT Strike Price DKK5.7500/$ Identify which rate should be used US borrowing AND investing 5% and 3% respectively 6% and 4% respectivelly Danish borrowing AND investing Cost of Capital (WACC) 10% Using data in the table above, you need to calculate proceeds of different hedging Question 4 1 pts Forward hedge (2) Find how much you will have to pay in 60 days if you choose to hedge in the forward market. (Round your answer to 2 decimals). Question 5 1 pts Money market hedge (1) Find the amount you need to invest today in DKK. You source Ice Cubes to sell in the US from an Eskimo village and you owe them DKK 3,000,000 which is due in 60 days. Greenland is part of Denmark and uses Danish Krona (DKK) as its currency. If the Currency exchange rates and interest rates are a as follows what is your hedging decision? Data Table Amount (to be paid in DKK) DKK3,000,000 Days 60 Spot DKK5.7200/$ DKK is sold at Premium of 2% Forward premium or discount (calculate) Expected change in FX rate (calculate) Identify what kind of Option should be used DKK is sold at Premium of 1.50% Premium - CALL Option 1% Premium - PUT Option 2% CALL Strike Price DKK5.7500/$ PUT Strike Price DKK5.7500/$ Identify which rate should be used US borrowing AND investing 5% and 3% respectively 6% and 4% respectivelly Danish borrowing AND investing Cost of Capital (WACC) 10% Using data in the table above, you need to calculate proceeds of different hedging Question 4 1 pts Forward hedge (2) Find how much you will have to pay in 60 days if you choose to hedge in the forward market. (Round your answer to 2 decimals). Question 5 1 pts Money market hedge (1) Find the amount you need to invest today in DKK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts