Question: You will also be required to use formulas for any totals in computing the book value. The lack of formulas will result in a lower

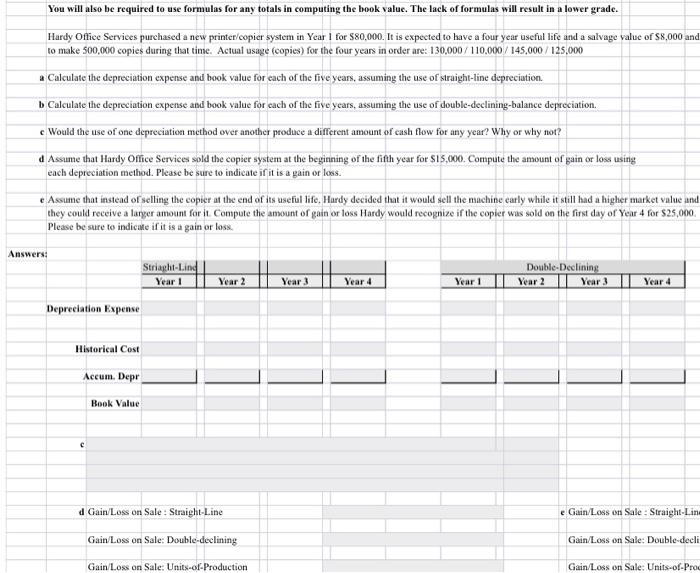

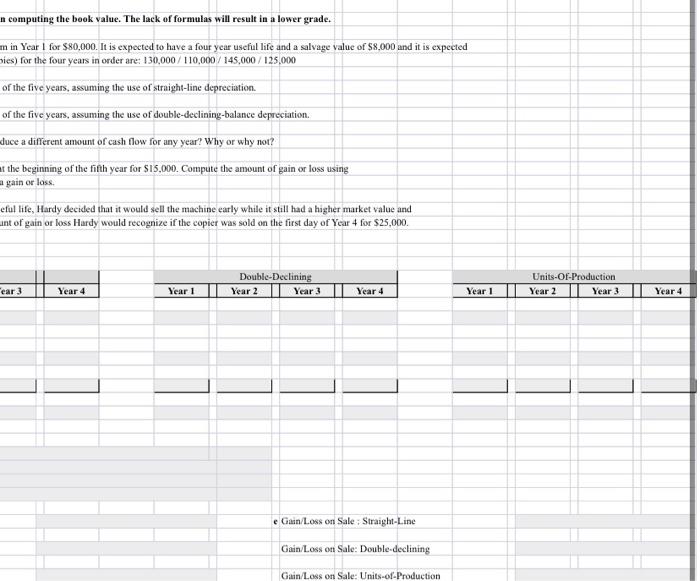

You will also be required to use formulas for any totals in computing the book value. The lack of formulas will result in a lower grade. Hardy Office Services purchased a new printer/copier system in Year 1 for $80,000. It is expected to have a four year useful life and a salvage value of 58,000 and to make 500,000 copies during that time. Actual usage (copies) for the four years in order are: 130,000/110,000/ 145,000/125.000 a Calculate the depreciation expense and book value for each of the five years, assuming the use of straight-line depreciation. b Calculate the depreciation expense and book value for cach of the five years, assuming the use of double-declining-balance depreciation. c Would the use of one depreciation method over another produce a different amount of cash flow for any year? Why or why not? d Assume that Hardy Office Services sold the copier system at the beginning of the fifth year for $15,000. Compute the amount of gain or loss using each depreciation method. Please be sure to indicate if it is a gain or loss. e Assume that instead of selling the copier at the end of its useful life. Hardy decided that it would sell the machine carly while it still had a higher market value and they could receive a larger amount for it Compute the amount of gain or loss Hardy would recognize if the copier was sold on the first day of Year 4 for $25,000 Please be sure to indicate if it is a gain or loss. Answers: Striaght-Lind Year 1 Double-Declining Year 2 Year 3 Year 2 Year 3 Year 4 Year 1 Year 4 Depreciation Expense Historical Cost Accum. Depr Book Value C d Gain/Loss on Sale: Straight-Line e Gain/Loss on Sale: Straight-Line Gain Loss on Sale: Double-declining Gain/Loss on Sale: Double-decli Gain Loss on Sale: Units-of-Production Gain Loss on Sale: Units-of-Pro a computing the book value. The lack of formulas will result in a lower grade. m in Year 1 for $80,000. It is expected to have a four year useful life and a salvage value of $8.000 and it is expected nies) for the four years in order are: 130,000/110,000/ 145,000/125.000 of the five years, assuming the use of straight-line depreciation. of the five years, assuming the use of double-declining-balance depreciation. duce a different amount of cash flow for any year? Why or why not? at the beginning of the fifth year for $15,000. Compute the amount of gain or loss using again or loss. eful life, Hardy decided that it would sell the machine early while it still had a higher market value and ant of gain or loss Hardy would recognize if the copier was sold on the first day of Year 4 for $25,000 Double-Declining Year 2 Year 3 Units-Of-Production Year 2 Year 3 "ear 3 Year 4 Year 1 Year 4 Year 1 Year 4 e Gain/Loss on Sale: Straight-Line Gain/Loss on Sale: Double-declining Gain Loss on Sale: Units-of-Production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts