Question: You will need to use Excel or Word to answer this question and then upload your file. Please ensure that you leave yourself enough

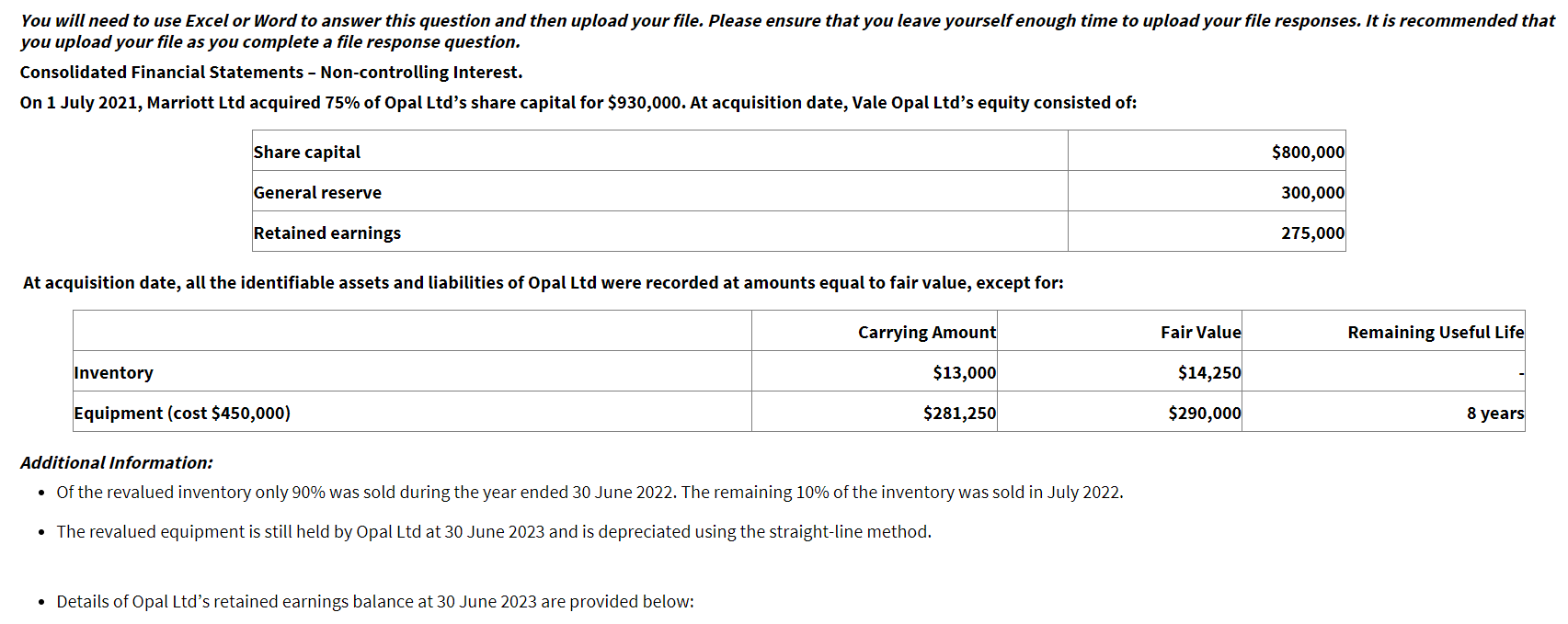

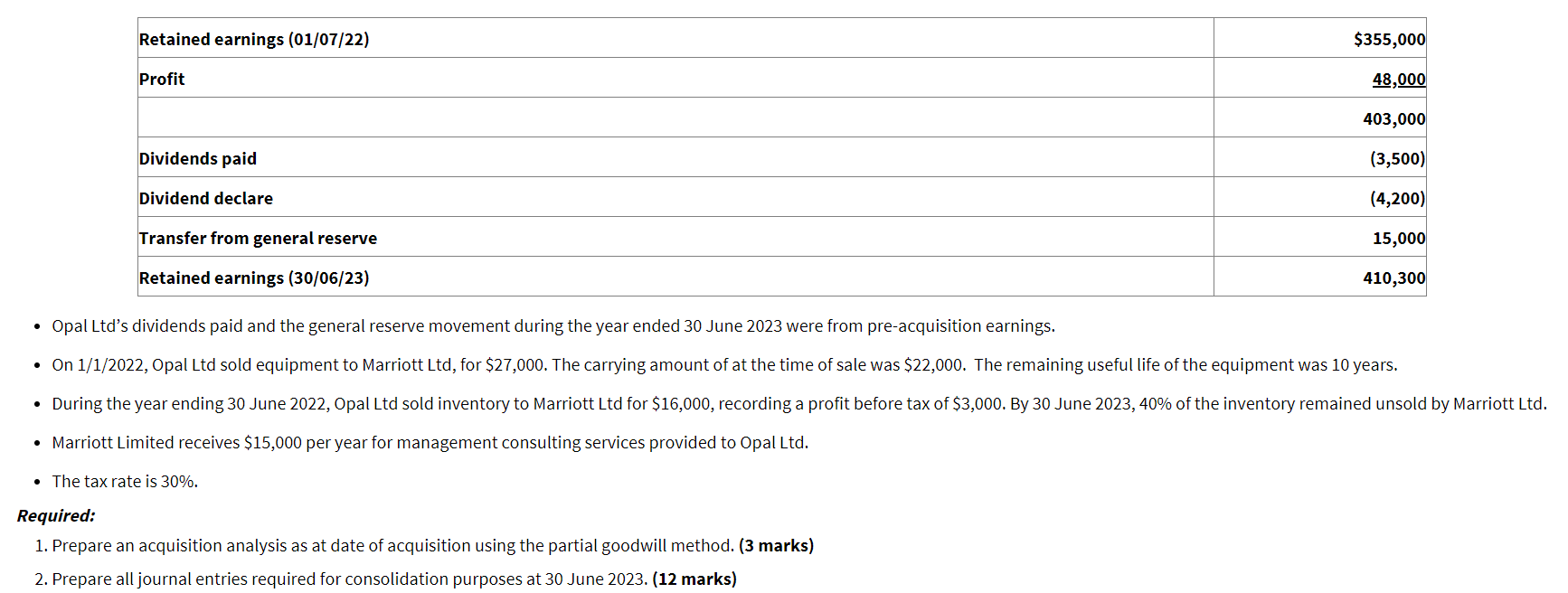

You will need to use Excel or Word to answer this question and then upload your file. Please ensure that you leave yourself enough time to upload your file responses. It is recommended that you upload your file as you complete a file response question. Consolidated Financial Statements - Non-controlling Interest. On 1 July 2021, Marriott Ltd acquired 75% of Opal Ltd's share capital for $930,000. At acquisition date, Vale Opal Ltd's equity consisted of: Share capital General reserve Retained earnings At acquisition date, all the identifiable assets and liabilities of Opal Ltd were recorded at amounts equal to fair value, except for: Inventory Equipment (cost $450,000) Additional Information: Of the revalued inventory only 90% was sold during the year ended 30 June 2022. The remaining 10% of the inventory was sold in July 2022. Carrying Amount $13,000 $281,250 The revalued equipment is still held by Opal Ltd at 30 June 2023 and is depreciated using the straight-line method. Details of Opal Ltd's retained earnings balance at 30 June 2023 are provided below: Fair Value $14,250 $290,000 $800,000 300,000 275,000 Remaining Useful Life 8 years Retained earnings (01/07/22) Profit Dividends paid Dividend declare Transfer from general reserve Retained earnings (30/06/23) $355,000 48,000 403,000 (3,500) (4,200) 15,000 410,300 Opal Ltd's dividends paid and the general reserve movement during the year ended 30 June 2023 were from pre-acquisition earnings. On 1/1/2022, Opal Ltd sold equipment to Marriott Ltd, for $27,000. The carrying amount of at the time of sale was $22,000. The remaining useful life of the equipment was 10 years. During the year ending 30 June 2022, Opal Ltd sold inventory to Marriott Ltd for $16,000, recording a profit before tax of $3,000. By 30 June 2023, 40% of the inventory remained unsold by Marriott Ltd. Marriott Limited receives $15,000 per year for management consulting services provided to Opal Ltd. The tax rate is 30%. Required: 1. Prepare an acquisition analysis as at date of acquisition using the partial goodwill method. (3 marks) 2. Prepare all journal entries required for consolidation purposes at 30 June 2023. (12 marks)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

1Acquisition Analysis using Partial Goodwill Method As of the date of acquisition July 1 2021 the ne... View full answer

Get step-by-step solutions from verified subject matter experts