Question: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The

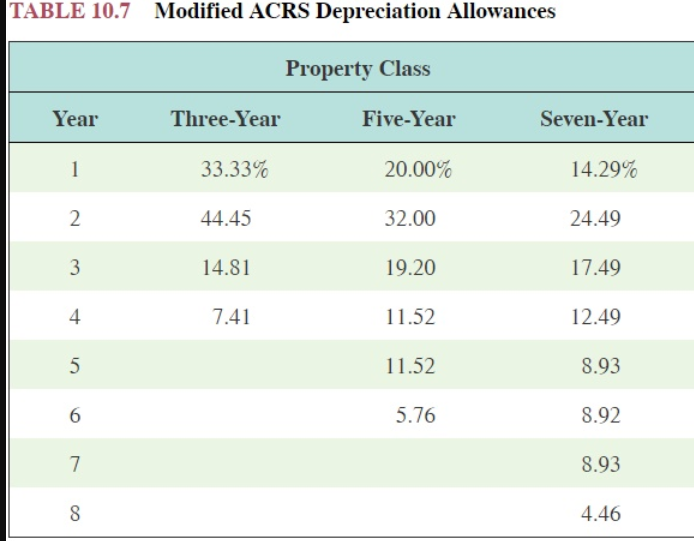

You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The scanner costs $5,300,000. Because of radiation contamination, it actually will be completely valueless in four years. You can lease it for $1,590,000 per year for four years. Assume that the tax rate is 25 percent. You can borrow at 8 percent before taxes. Assume that the scanner will be depreciated as three-year property under MACRS. Use Table 10.7.

a. What is the NAL of the lease? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Should you lease or buy?

TABLE 10.7 Modified ACRS Depreciation Allowances Property Class Year Three-Year Five-Year Seven-Year 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 a. NAL b. Buy Leased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts