Question: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner

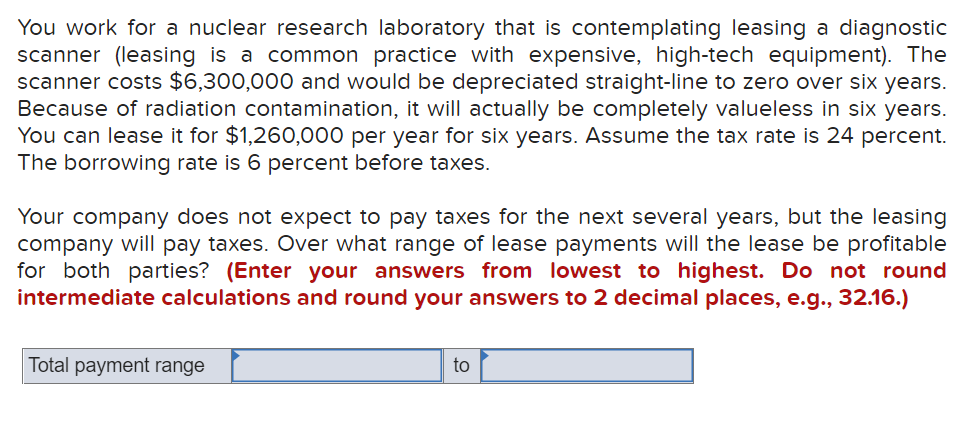

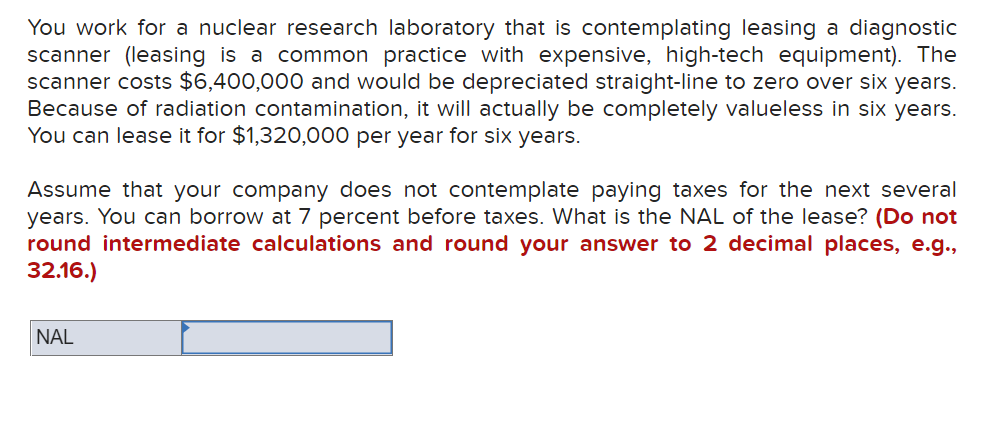

You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $6,300,000 and would be depreciated straight-line to zero over six years. Because of radiation contamination, it will actually be completely valueless in six years. You can lease it for $1,260,000 per year for six years. Assume the tax rate is 24 percent. The borrowing rate is 6 percent before taxes. Your company does not expect to pay taxes for the next several years, but the leasing company will pay taxes. Over what range of lease payments will the lease be profitable for both parties? (Enter your answers from lowest to highest. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Total payment range to You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $6,400,000 and would be depreciated straight-line to zero over six years. Because of radiation contamination, it will actually be completely valueless in six years. You can lease it for $1,320,000 per year for six years. Assume that your company does not contemplate paying taxes for the next several years. You can borrow at 7 percent before taxes. What is the NAL of the lease? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts