Question: You would like to construct an optimal portfolio to maximize your mean-variance utility U = E[r] *A*Variance with a risk-aversion A=2. Your investment horizon is

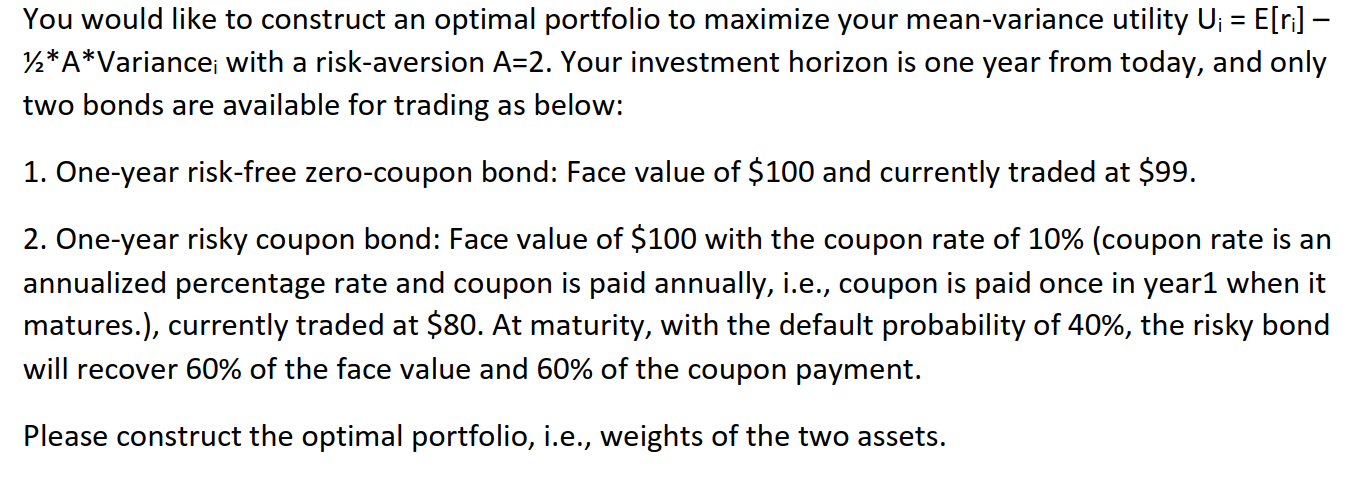

You would like to construct an optimal portfolio to maximize your mean-variance utility U = E[r] *A*Variance with a risk-aversion A=2. Your investment horizon is one year from today, and only two bonds are available for trading as below: 1. One-year risk-free zero-coupon bond: Face value of $100 and currently traded at $99. 2. One-year risky coupon bond: Face value of $100 with the coupon rate of 10% (coupon rate is an annualized percentage rate and coupon is paid annually, i.e., coupon is paid once in year1 when it matures.), currently traded at $80. At maturity, with the default probability of 40%, the risky bond will recover 60% of the face value and 60% of the coupon payment. Please construct the optimal portfolio, i.e., weights of the two assets. You would like to construct an optimal portfolio to maximize your mean-variance utility U = E[r] *A*Variance with a risk-aversion A=2. Your investment horizon is one year from today, and only two bonds are available for trading as below: 1. One-year risk-free zero-coupon bond: Face value of $100 and currently traded at $99. 2. One-year risky coupon bond: Face value of $100 with the coupon rate of 10% (coupon rate is an annualized percentage rate and coupon is paid annually, i.e., coupon is paid once in year1 when it matures.), currently traded at $80. At maturity, with the default probability of 40%, the risky bond will recover 60% of the face value and 60% of the coupon payment. Please construct the optimal portfolio, i.e., weights of the two assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts