Question: You would like to create a bull call spread using the following quotes: Option type Calls on Stock ABC Exercise price Option premium $20 $6.50

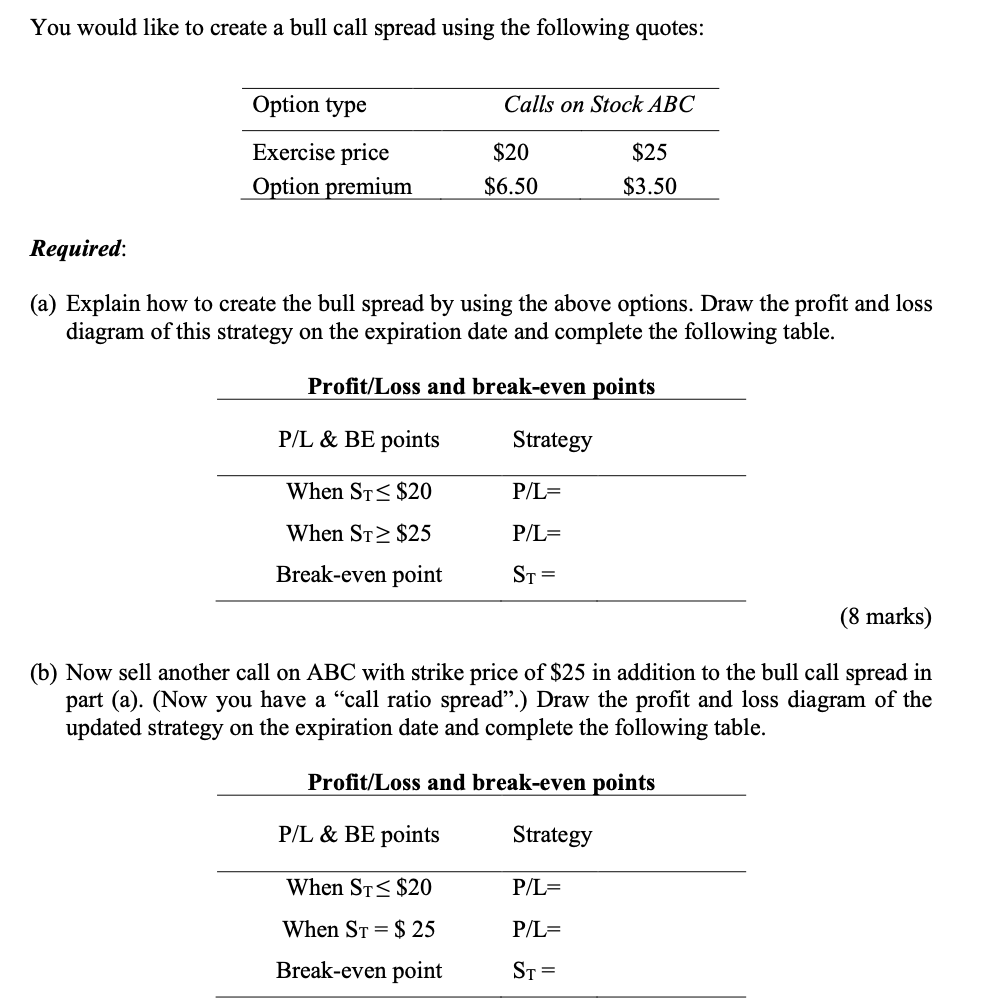

You would like to create a bull call spread using the following quotes: Option type Calls on Stock ABC Exercise price Option premium $20 $6.50 $25 $3.50 Required: (a) Explain how to create the bull spread by using the above options. Draw the profit and loss diagram of this strategy on the expiration date and complete the following table. Profit/Loss and break-even points P/L & BE points Strategy When St $25 P/L= Break-even point ST= (8 marks) (b) Now sell another call on ABC with strike price of $25 in addition to the bull call spread in part (a). (Now you have a call ratio spread.) Draw the profit and loss diagram of the updated strategy on the expiration date and complete the following table. Profit/Loss and break-even points P/L & BE points Strategy When St $25 P/L= Break-even point ST= (8 marks) (b) Now sell another call on ABC with strike price of $25 in addition to the bull call spread in part (a). (Now you have a call ratio spread.) Draw the profit and loss diagram of the updated strategy on the expiration date and complete the following table. Profit/Loss and break-even points P/L & BE points Strategy When St

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts