Question: Your answer is incorrect. A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.52 that consumers will

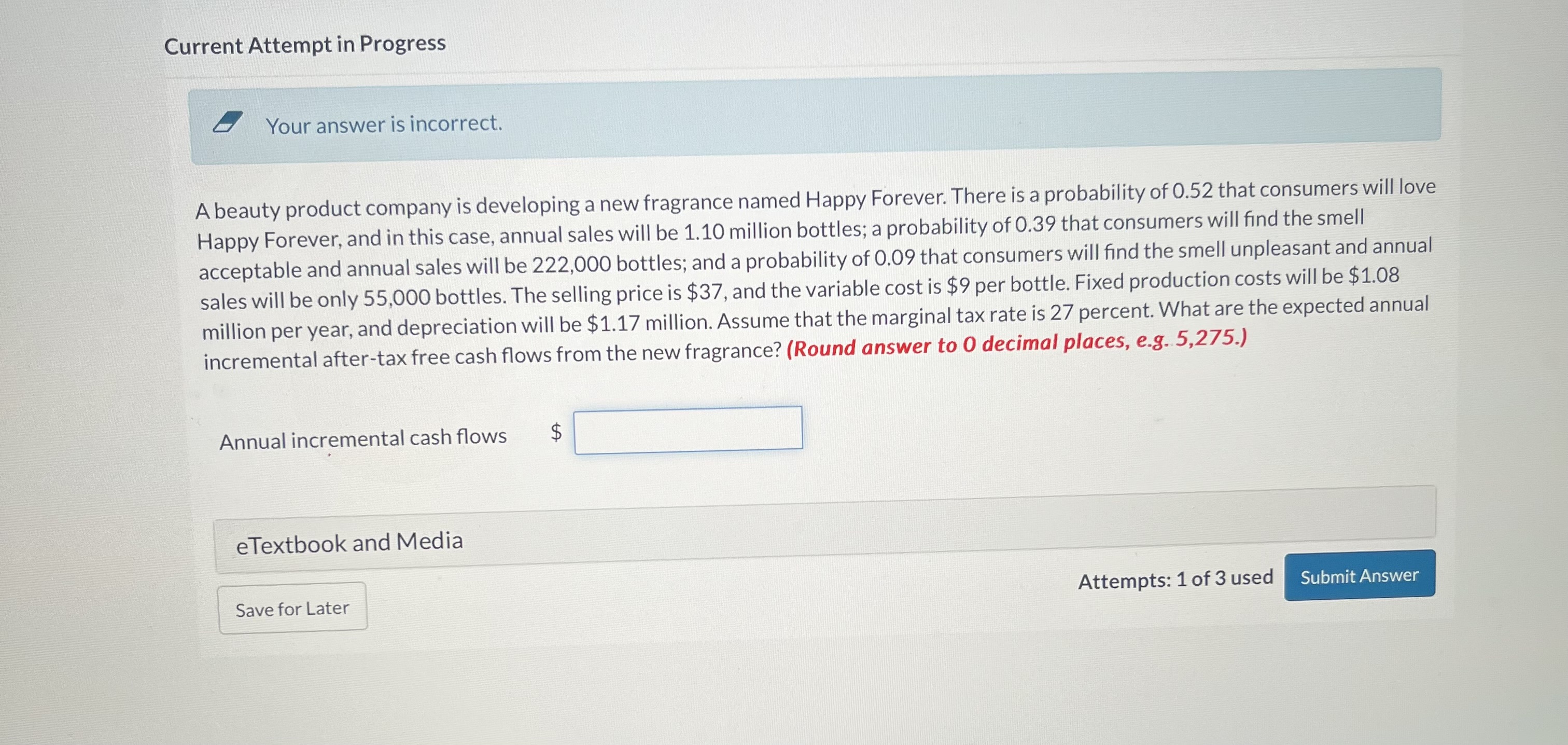

Your answer is incorrect. A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.52 that consumers will love Happy Forever, and in this case, annual sales will be 1.10 million bottles; a probability of 0.39 that consumers will find the smell acceptable and annual sales will be 222,000 bottles; and a probability of 0.09 that consumers will find the smell unpleasant and annual sales will be only 55,000 bottles. The selling price is $37, and the variable cost is $9 per bottle. Fixed production costs will be $1.08 million per year, and depreciation will be $1.17 million. Assume that the marginal tax rate is 27 percent. What are the expected annual incremental after-tax free cash flows from the new fragrance? (Round answer to 0 decimal places, e.g. 5,275.) Annual incremental cash flows $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts