Question: Your answer is incorrect. A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.50 that consumers will

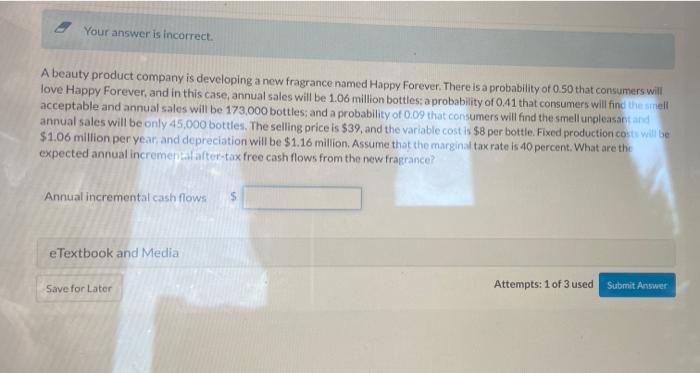

Your answer is incorrect. A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.50 that consumers will love Happy Forever, and in this case, annual sales will be 1.06 million bottles: a probability of 0.41 that consumers will find the small acceptable and annual sales will be 173,000 bottles; and a probability of 0.09 that consumers will find the smell unpleasant and annual sales will be only 45,000 bottles. The selling price is $39, and the variable cost is $8 per bottle. Fixed production cost will be $1.06 million per year, and depreciation will be $1.16 million. Assume that the marginal tax rate is 40 percent. What are the expected annual incrementafter-tax free cash flows from the new fragrance? Annual incremental cash flows e Textbook and Media Save for Later Attempts: 1 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts