Question: * Your answer is incorrect. Margaret is single and maintains a household for her two dependent children who are ages 6 and 8 . She

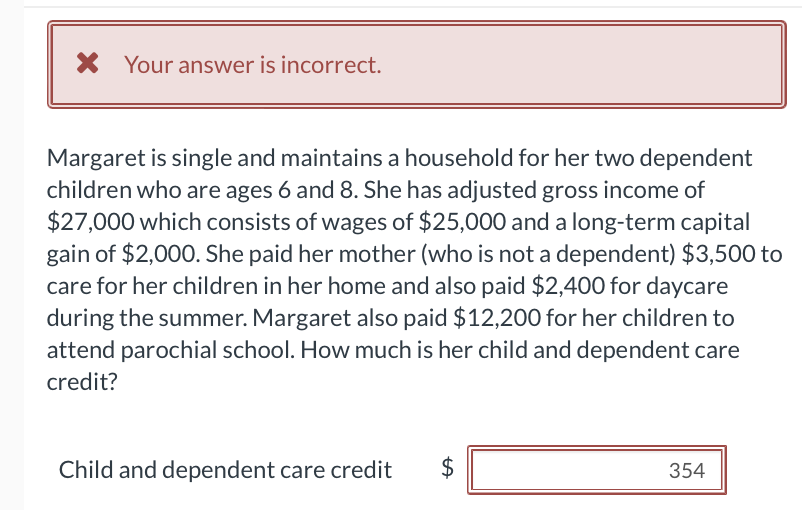

* Your answer is incorrect. Margaret is single and maintains a household for her two dependent children who are ages 6 and 8 . She has adjusted gross income of $27,000 which consists of wages of $25,000 and a long-term capital gain of $2,000. She paid her mother (who is not a dependent) $3,500 to care for her children in her home and also paid $2,400 for daycare during the summer. Margaret also paid $12,200 for her children to attend parochial school. How much is her child and dependent care credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock