Question: Your answer is incorrect. The correct answer is: $67374 Can you guys show me how this is done? Thanks. During 20x1, Brandon Inc. purchased 1921,

Your answer is incorrect.

The correct answer is: $67374

Can you guys show me how this is done? Thanks.

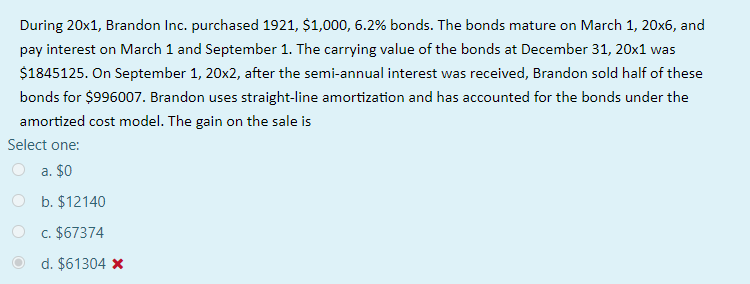

During 20x1, Brandon Inc. purchased 1921, $1,000, 6.2% bonds. The bonds mature on March 1, 20x6, and pay interest on March 1 and September 1. The carrying value of the bonds at December 31, 20x1 was $1845125. On September 1, 20x2, after the semi-annual interest was received, Brandon sold half of these bonds for $996007. Brandon uses straight-line amortization and has accounted for the bonds under the amortized cost model. The gain on the sale is Select one: a. $0 b. $12140 c. $67374 d. $61304 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts