Question: Your answer is partially correct. On January 1 , 2 0 2 5 , Waterway Company issued 1 0 - year, $ 1 , 8

Your answer is partially correct.

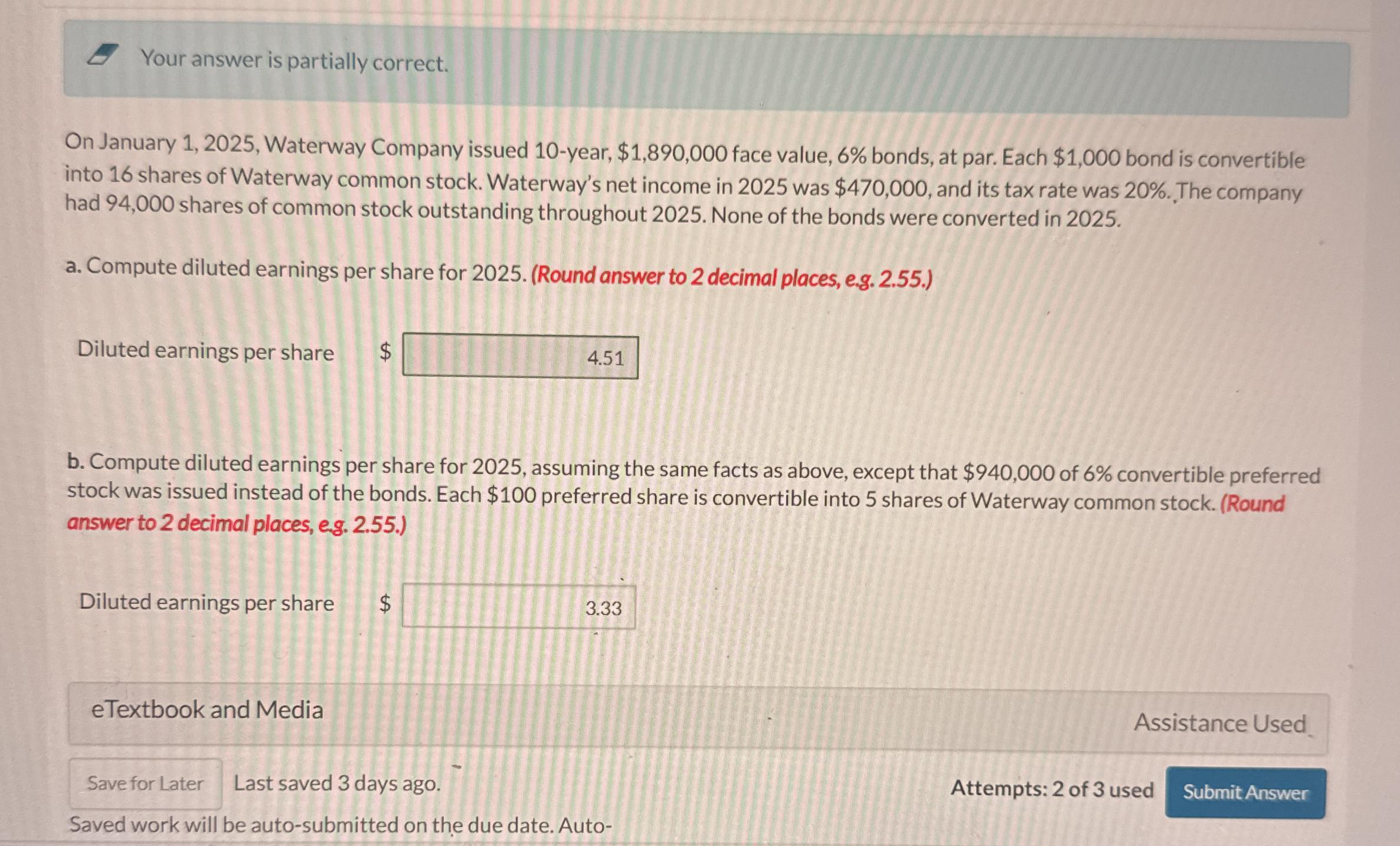

On January Waterway Company issued year, $ face value, bonds, at par. Each $ bond is convertible into shares of Waterway common stock. Waterway's net income in was $ and its tax rate was The company had shares of common stock outstanding throughout None of the bonds were converted in

a Compute diluted earnings per share for Round answer to decimal places, eg

Diluted earnings per share

$

b Compute diluted earnings per share for assuming the same facts as above, except that $ of convertible preferred stock was issued instead of the bonds. Each $ preferred share is convertible into shares of Waterway common stock. Round answer to decimal places, eg

Diluted earnings per share

$

eTextbook and Media

Assistance Used

Last saved days ago.

Attempts: of used

Saved work will be autosubmitted on the due date. The answers are not or please solve correcly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock