Question: Your answer is partially correct. Prepare the journal entry on June 30 when SJW receives its property tax notice. (Credit account titles are automatically

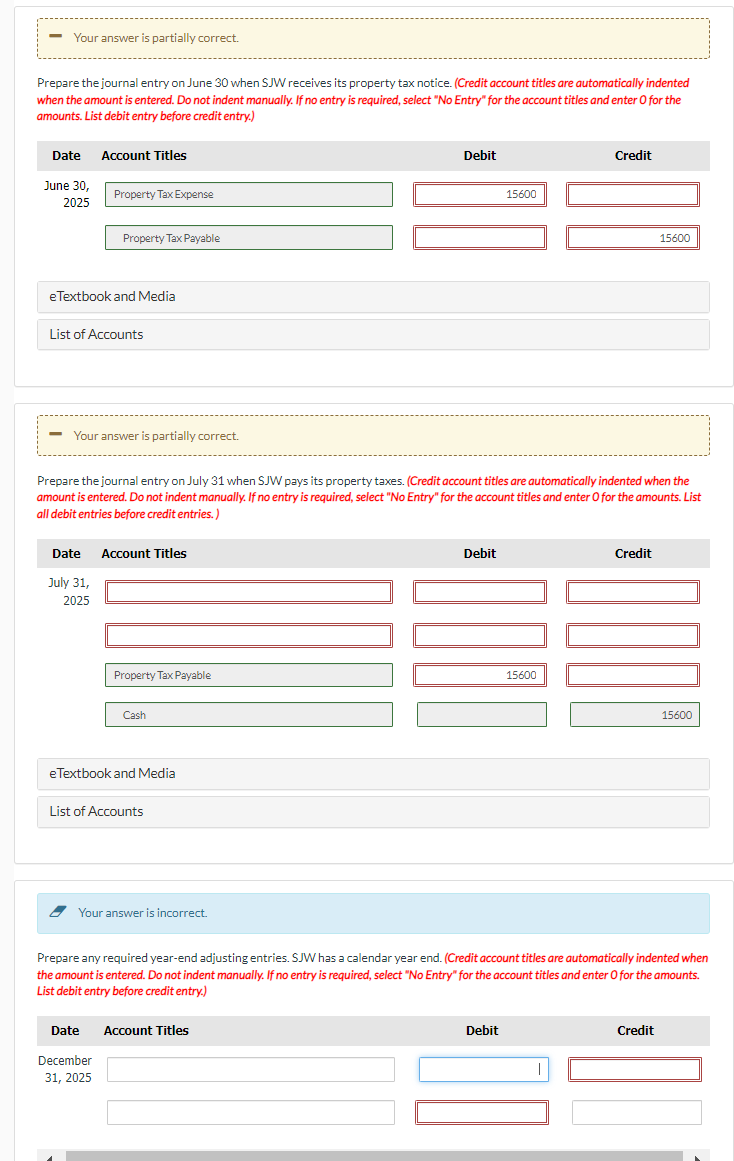

Your answer is partially correct. Prepare the journal entry on June 30 when SJW receives its property tax notice. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles June 30, 2025 Property Tax Expense Property Tax Payable eTextbook and Media List of Accounts Your answer is partially correct. Debit 15600 Credit 15600 Prepare the journal entry on July 31 when SJW pays its property taxes. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles July 31, 2025 Debit Credit Property Tax Payable 15600 Cash eTextbook and Media List of Accounts Your answer is incorrect. 15600 Prepare any required year-end adjusting entries. SJW has a calendar year end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles December 31, 2025 Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts