Question: Your answer is partially correct. Try again Hodge Co. exchanged Building 24 which has an appraised value of $4,944,000, a cost of $7,669,000, and accumulated

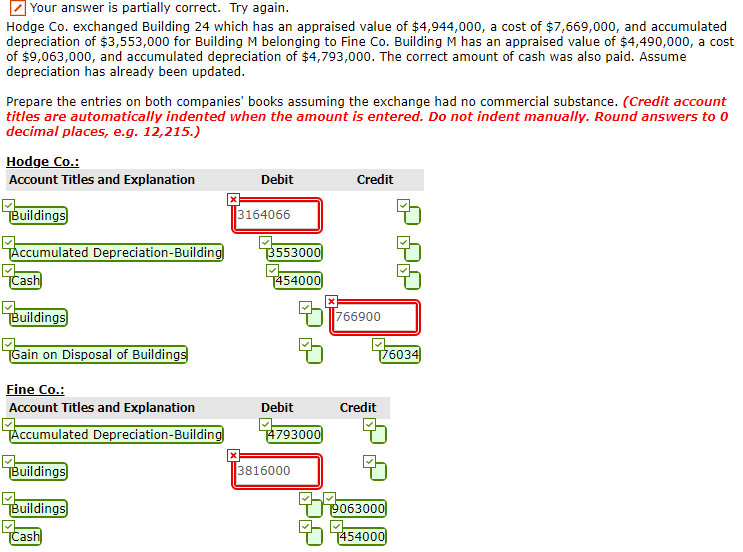

Your answer is partially correct. Try again Hodge Co. exchanged Building 24 which has an appraised value of $4,944,000, a cost of $7,669,000, and accumulated depreciation of $3,553,000 for Building M belonging to Fine Co. Building M has an appraised value of $4,490,000, a cost of $9,063,000, and accumulated depreciation of $4,793,000. The correct amount of cash was also paid. Assume depreciation has already been updated Prepare the entries on both companies' books assuming the exchange had no commercial substance. (Credit accounit titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 12,215.) Hodge Co.: Account Titles and Explanation Debit Credit uildings 3164066 ccumulated Depreciation-Building 55300 as 5400 uildings 766900 ain on Disposal of Building 6034 ine CO.: Account Titles and Explanation Debit Credit g7930 % ccumulated Depreciation-Building uildings 3816000 euildings 063000 Cash 5400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts