Question: Your associate wants you to complete a model they started. They are setting up a Monte Carlo model to value both a 1 year

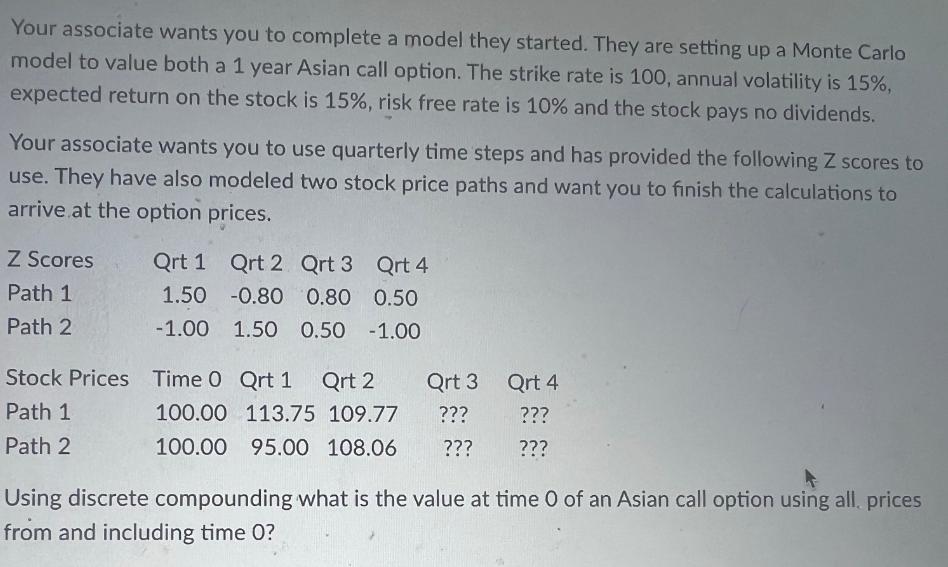

Your associate wants you to complete a model they started. They are setting up a Monte Carlo model to value both a 1 year Asian call option. The strike rate is 100, annual volatility is 15%, expected return on the stock is 15%, risk free rate is 10% and the stock pays no dividends. Your associate wants you to use quarterly time steps and has provided the following Z scores to use. They have also modeled two stock price paths and want you to finish the calculations to arrive at the option prices. Z Scores Path 1 Path 2 Stock Prices Path 1 Path 2 Qrt 1 Qrt 2 Qrt 3 1.50 -1.00 Qrt 4 -0.80 0.80 0.50 1.50 0.50 -1.00 Time 0 Qrt 3 Qrt 1 Qrt 2 100.00 113.75 109.77 ??? 100.00 95.00 108.06 ??? Qrt 4 ??? ??? Using discrete compounding what is the value at time 0 of an Asian call option using all, prices from and including time 0?

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

To value the Asian call option using the Monte Carlo method we need to simulate the stock price path... View full answer

Get step-by-step solutions from verified subject matter experts