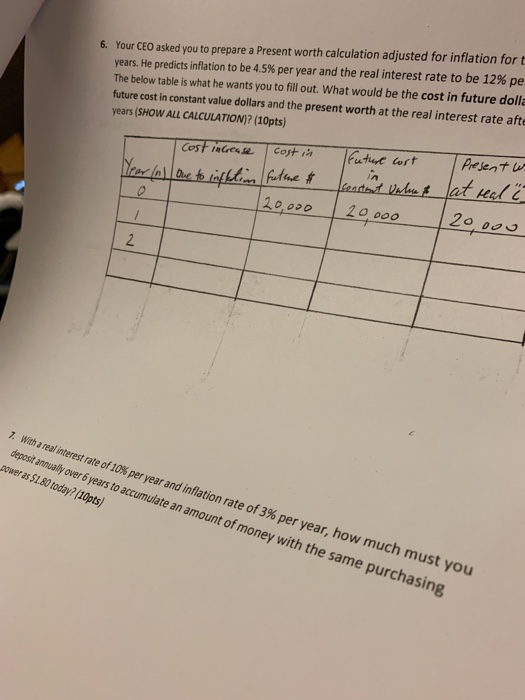

Question: Your CEO asked you to prepare a Present worth calculation adjusted for inflation for t years. He predicts inflation to be 45% per year and

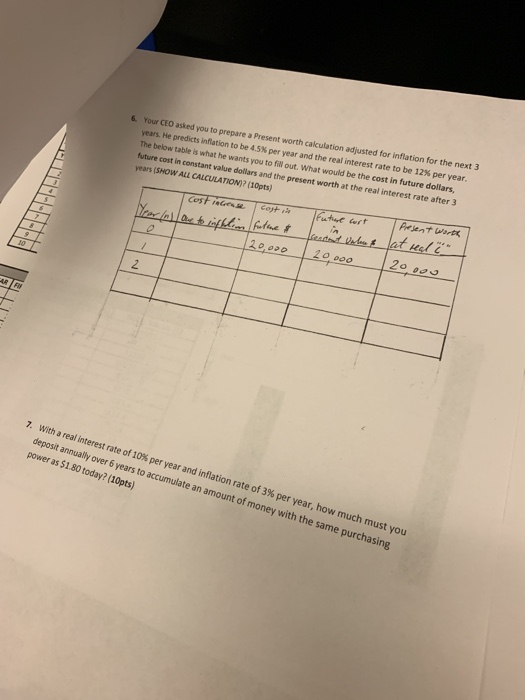

Your CEO asked you to prepare a Present worth calculation adjusted for inflation for t years. He predicts inflation to be 45% per year and the real interest rate to be 12% pe The below table is what he wants you to fill out. What would be the cost in future doll future cost in constant value dollars and the present worth at the real interest rate afte years (SHOW ALL CALCULATION)? (10pts) 6. | Pesentu 20 00 |futu.cart Cost indessel co 2o,ooo 20 00o real interest rate of 10% per year and inflation rate of 3% per year, how much must you deposit annul ower as $1.80 today?(10pts) over 6years to accumulate an amount of money with the same purch te calculation adjusted for inflation for the next 3 and the real interest rate to be 12% per year. a Present worth Your CEO asked you to prepare years. He predicts inflation to be 4.5% per year The below table is what he wants you to fill out. What would be the cost in future dollars, 6. future cost in constant value dollars and the present worth at the real interest rate after3 years (SHOW ALL CALCULATION)? (10pts) 2 7. With a real interest rate of 10% per year and inflation rate of 3% per year, how much must you deposit annually over 6 years to accumulate an amount of money with the same purchasing power as $1.80 today? (10pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts