Question: Your client for this project is a C - corporation named Boy Genius, Inc. Your assignment is to complete and turn in the client s

Your client for this project is a Ccorporation named Boy Genius, Inc. Your assignment

is to complete and turn in the clients Form along with all required forms and

schedules. For purposes of this assignment, you do not need to complete or attach any

Forms W or K You should also ignore any penalties that the taxpayer

may have incurred and ignore any AMT considerations.

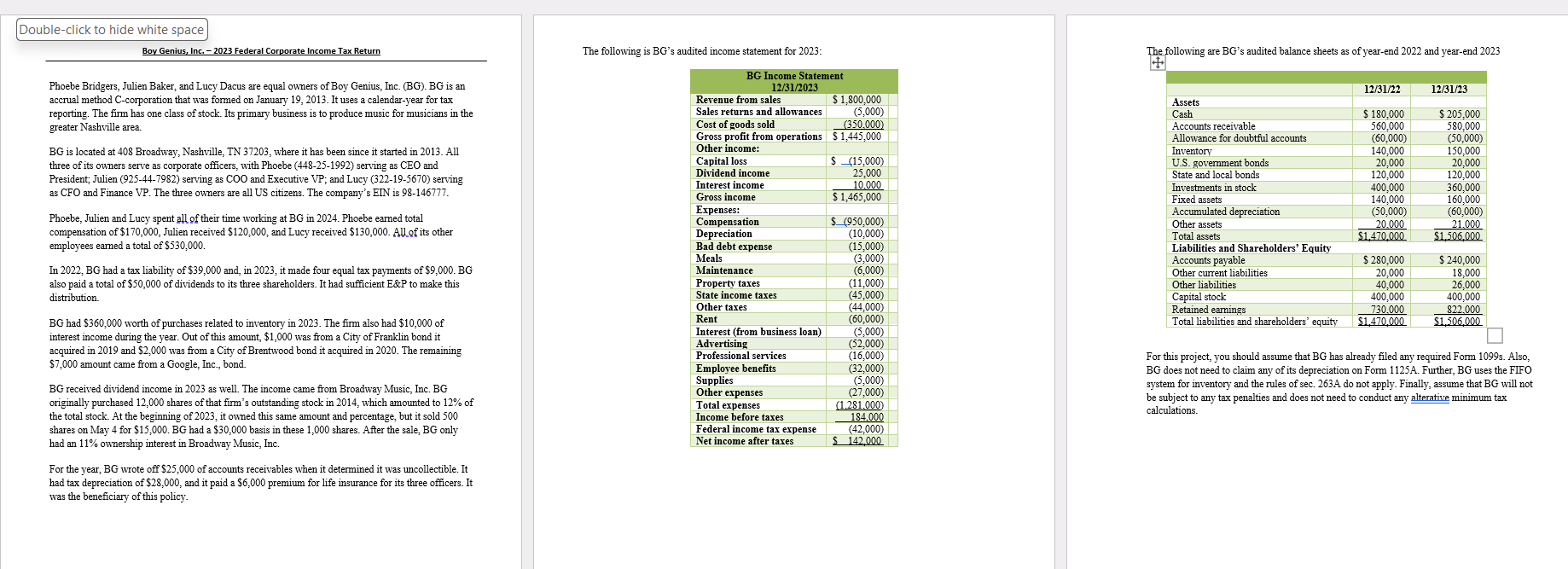

Phoebe Bridgers, Julien Baker, and Lucy Dacus are equal owners of Boy Genius, Inc. BG BG is an accrual method Ccorporation that was formed on January It uses a calendaryear for tax reporting. The firm has one class of stock. Its primary business is to produce music for musicians in the greater Nashville area.

BG is located at Broadway, Nashville, TN where it has been since it started in All three of its owners serve as corporate officers, with Phoebe serving as CEO and President; Julien serving as COO and Executive VP; and Lucy serving as CFO and Finance VP The three owners are all US citizens. The company's EIN is

Phoebe, Julien and Lucy spent all of their time working at BG in Phoebe earned total compensation of $ Julien received $ and Lucy received $ Allsf its other employees earned a total of $

In mathrmBG had a tax liability of $ and, in it made four equal tax payments of $ BG also paid a total of $ of dividends to its three shareholders. It had sufficient E&P to make this distribution.

BG had $ worth of purchases related to inventory in The firm also had $ of interest income during the year. Out of this amount, $ was from a City of Franklin bond it acquired in and $ was from a City of Brentwood bond it acquired in The remaining $ amount came from a Google, Inc., bond.

BG received dividend income in as well. The income came from Broadway Music, Inc. BG originally purchased shares of that firm's outstanding stock in which amounted to of the total stock. At the beginning of it owned this same amount and percentage, but it sold shares on May for $ BG had a $ basis in these shares. After the sale, BG only had an ownership interest in Broadway Music, Inc.

For the year, BG wrote off $ of accounts receivables when it determined it was uncollectible. It had tax depreciation of $ and it paid a $ premium for life insurance for its three officers. It was the beneficiary of this policy. The following is BGs audited income statement for : The following are BGs audited balance sheets as of yearend and yearend

begintabularccc

hline & &

hline multicolumnlAssets

hline Cash & $ & $

hline Accounts receivable & &

hline Allowance for doubtful accounts & &

hline Inventory & &

hline US govermment bonds & &

hline State and local bonds & &

hline Investments in stock & &

hline Fixed assets & &

hline Accumulated depreciation & &

hline Other assets & &

hline Total assets & $ & $

hline multicolumnlLiabilities and Shareholders' Equity

hline Accounts payable & $ & $

hline Other current liabilities & &

hline Other liabilities & &

hline Capital stock & &

hline Retained earnings & &

hline Total liabilities and shareholders' equity & $ & $

hline

endtabular

For this project, you should assume that BG has already filed any required Form s Also, BG does not need to claim any of its depreciation on Form A Further, BG uses the FIFO system for inventory and the rules of secA do not apply. Finally, assume that BG will not be subject to any tax penalties and does not need to conduct any alterative minimum tax calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock