Question: Your client, Sandra is considering three assets: a bond mutual fund, a cryptocurrency ETF, and US Treasury bills. The annualized T-bill rate is 2%. The

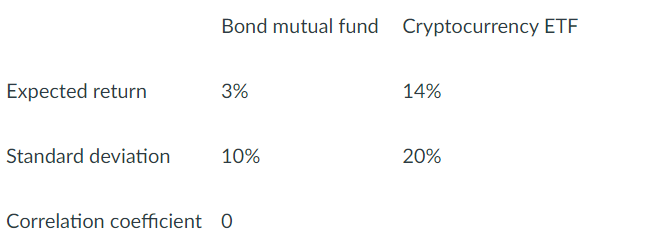

Your client, Sandra is considering three assets: a bond mutual fund, a cryptocurrency ETF, and US Treasury bills. The annualized T-bill rate is 2%. The information below refers to the two risky assets.

(a) What are the proportions of each asset, in Sandra's optimal risky portfolio?

(b) Suppose the return for each risky asset follows a normal distribution. What is the 1% value-at-risk for Sandras optimal risky portfolio? Hint: P(ZZ~N(0, 1).

Correlation coefficient 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts