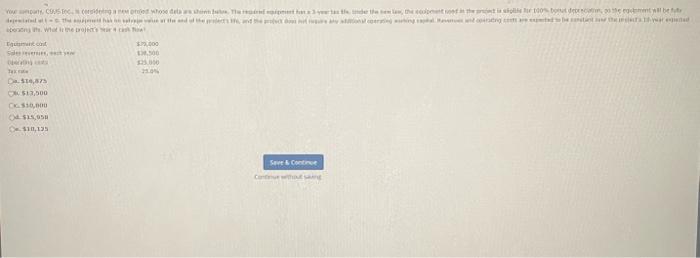

Question: Your company. CSUS Inc., is considering a new proiect whose data are shown below. The reauired eauloment has a 3-vear tax life. Under the new

Your company. CSUS Inc., is considering a new proiect whose data are shown below. The reauired eauloment has a 3-vear tax life. Under the new law. the eauinment used in the project is eligible for 100% bonus depreciation, so the equipment will be fully depreciated at t=0. the equipment has no salvage

ralue at the end of the proiect's life and the nroiect dops not require an additional onerating working capital. Revenues and operating costs are expected to be constant over the project's 10-year expected

operating life. What is the project's Year 4 cash flow?

EquIpment cost $70,000

Sales revenues. each vear $38,500

operating costs $25,000

tax rate 25.0%

a. $16,875

b. $13.500

C. $10,800

d. S15.958

e. $10.125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts