Question: Your company is considering a new project with an initial investment of $ 3 0 0 , 0 0 0 . The project is expected

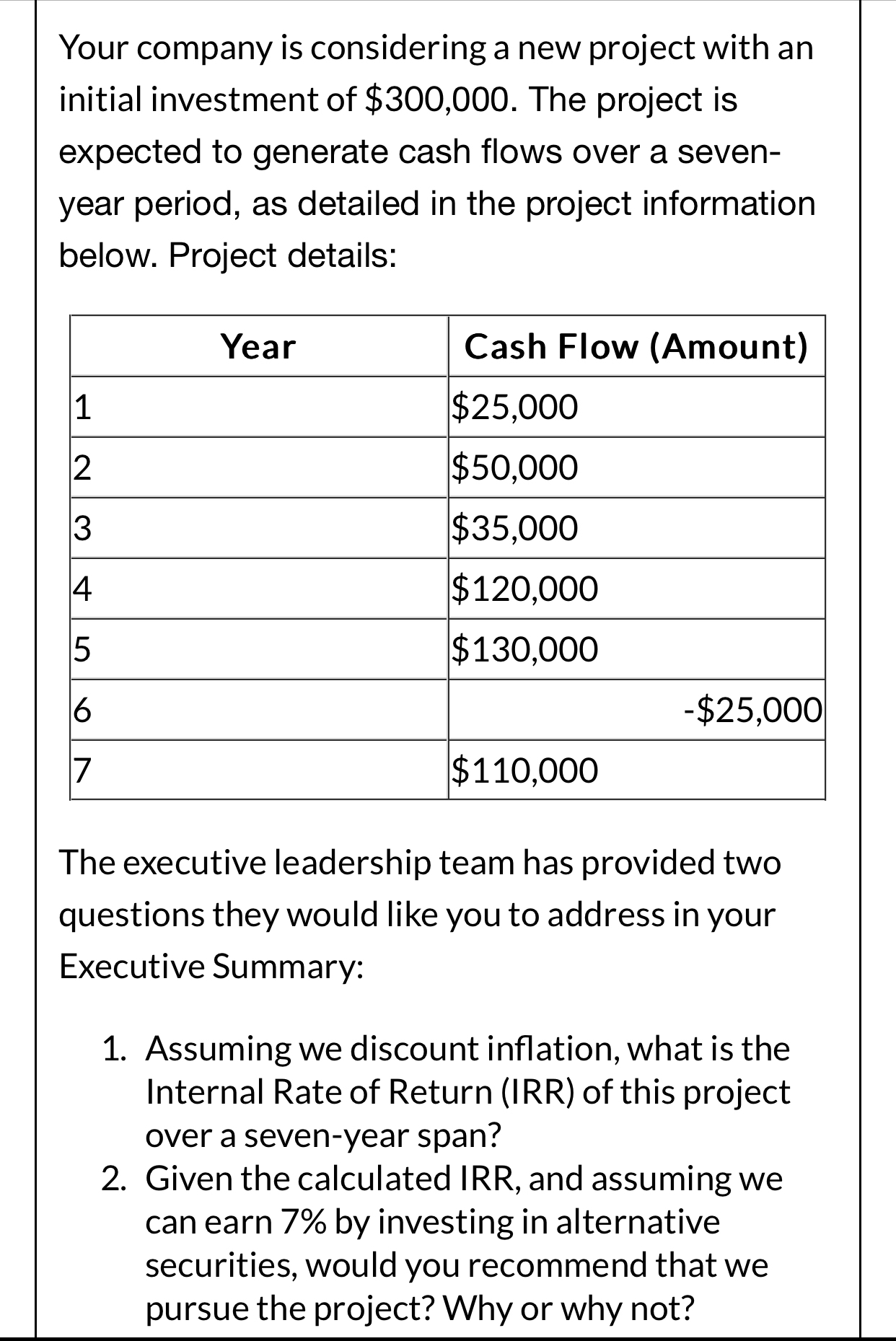

Your company is considering a new project with an

initial investment of $ The project is

expected to generate cash flows over a seven

year period, as detailed in the project information

below. Project details:

The executive leadership team has provided two

questions they would like you to address in your

Executive Summary:

Assuming we discount inflation, what is the

Internal Rate of Return IRR of this project

over a sevenyear span?

Given the calculated IRR, and assuming we

can earn by investing in alternative

securities would you recommend that we

pursue the project? Why or why not?

Step Analyze the project's cash flows

Calculate NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock