Question: Your company is evaluating two projects and has collected the following information: Project A 12% Same as existing Project B 79% Same as existing Expected

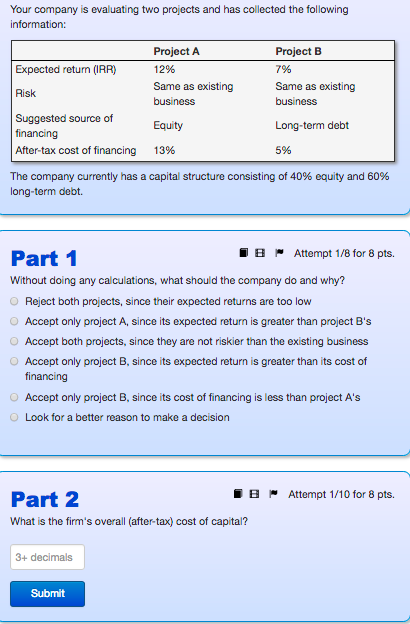

Your company is evaluating two projects and has collected the following information: Project A 12% Same as existing Project B 79% Same as existing Expected return (IRR) Risk business business Suggested source of financing After-tax cost of financing Long-term debt 13% 5% The company currently has a capital structure consisting of 40% equity and 60% long-term debt. Part 1 Without doing any calculations, what should the company do and why? O Reject both projects, since their expected returns are too low O Accept only project A, since its expected return is greater than project B's O Accept both projects, since they are not riskier than the existing business O Accept only project B, since its expected return is greater than its cost of Attempt 1 /8 for 8 pts. financing O Accept only project B, since its cost of financing is less than project A's O Look for a better reason to make a decision B F Attempt 1/10 for 8 pts. Part 2 What is the firm's overall (after-tax) cost of capital? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts