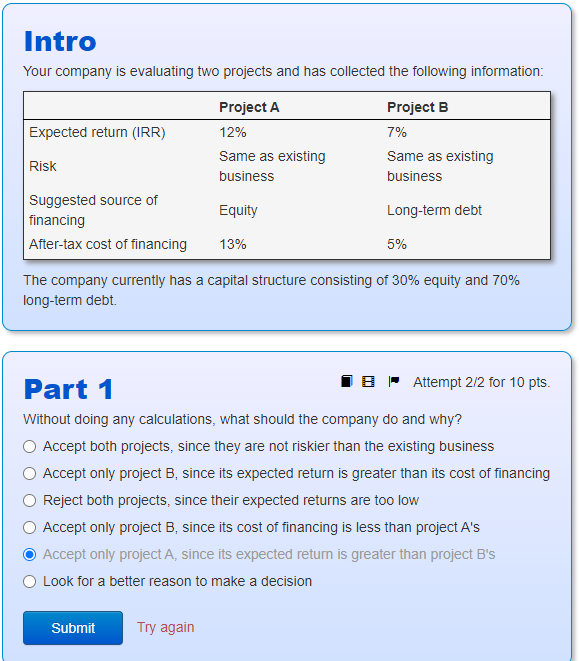

Question: Intro Your company is evaluating two projects and has collected the following information: The company currently has a capital structure consisting of 30% equity and

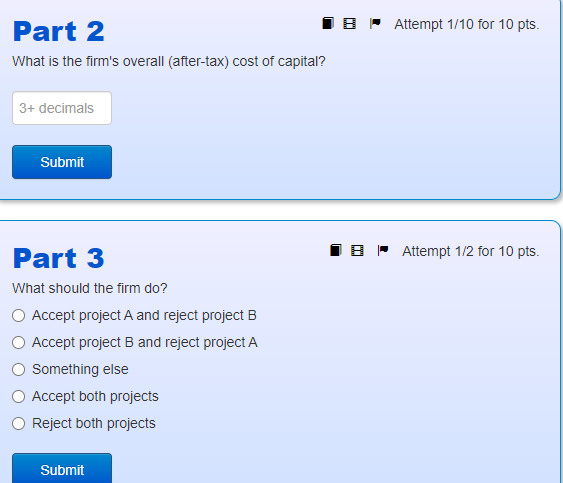

Intro Your company is evaluating two projects and has collected the following information: The company currently has a capital structure consisting of 30% equity and 70% long-term debt. Part 1 Attempt 2/2 for 10 pts. Without doing any calculations, what should the company do and why? Accept both projects, since they are not riskier than the existing business Accept only project B, since its expected return is greater than its cost of financing Reject both projects, since their expected returns are too low Accept only project B, since its cost of financing is less than project A's Accept only project A, since its expected return is greater than project B's Look for a better reason to make a decision Try again What is the firm's overall (after-tax) cost of capital? Part 3 Attempt 1/2 for 10 pts. What should the firm do? Accept project A and reject project B Accept project B and reject project A Something else Accept both projects Reject both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts