Question: Your company is evaluating whether purchasing or leasing some transportation equipment for the next six years. You received the task to perform an acutual-dollar after-tax

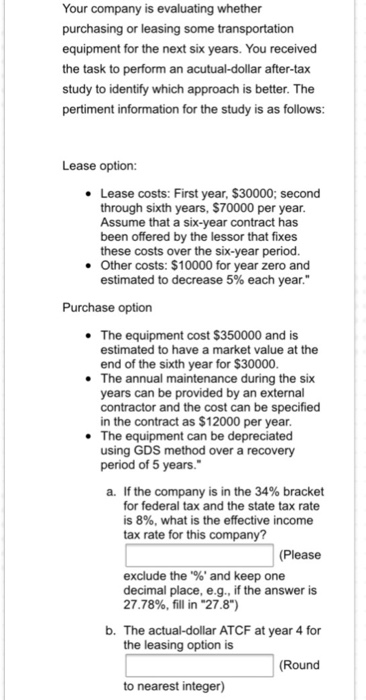

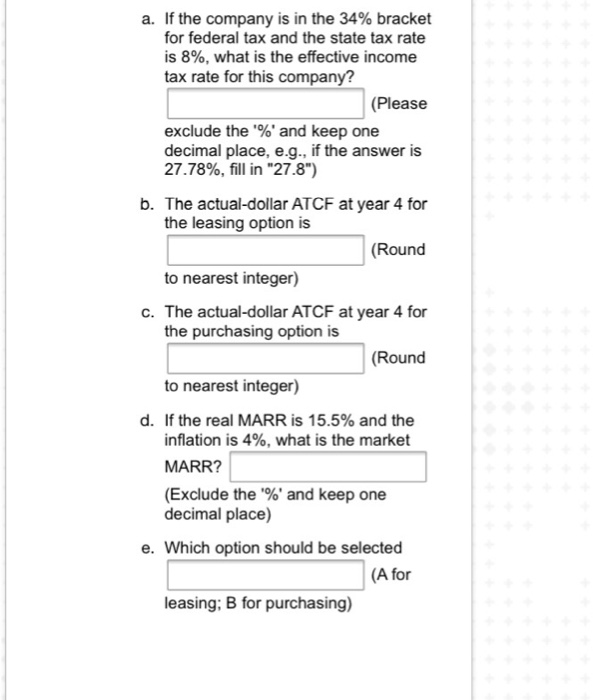

Your company is evaluating whether purchasing or leasing some transportation equipment for the next six years. You received the task to perform an acutual-dollar after-tax study to identify which approach is better. The pertiment information for the study is as follows: Lease option: Lease costs: First year, $30000; second through sixth years, S70000 per year. Assume that a six-year contract has been offered by the lessor that fixes these costs over the six-year period. Other costs: $10000 for year zero and estimated to decrease 5% each year." Purchase option The equipment cost $350000 and is estimated to have a market value at the end of the sixth year for $30000 The annual maintenance during the six years can be provided by an external contractor and the cost can be specified in the contract as $12000 per year. The equipment can be depreciated using GDS method over a recovery period of 5 years." a. If the company is in the 34% bracket for federal tax and the state tax rate is 8%, what is the effective income tax rate for this company? (Please exclude the %. and keep one decimal place, e.g., if the answer is 27.78%, fill in "27.8") b. The actual-dollar ATCF at year 4 for the leasing option is (Round to nearest integer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts