Question: 1. ABC company is evaluating whether purchasing or leasing a drilling equipment for the next six years. You received the task to perform an actual-dollar

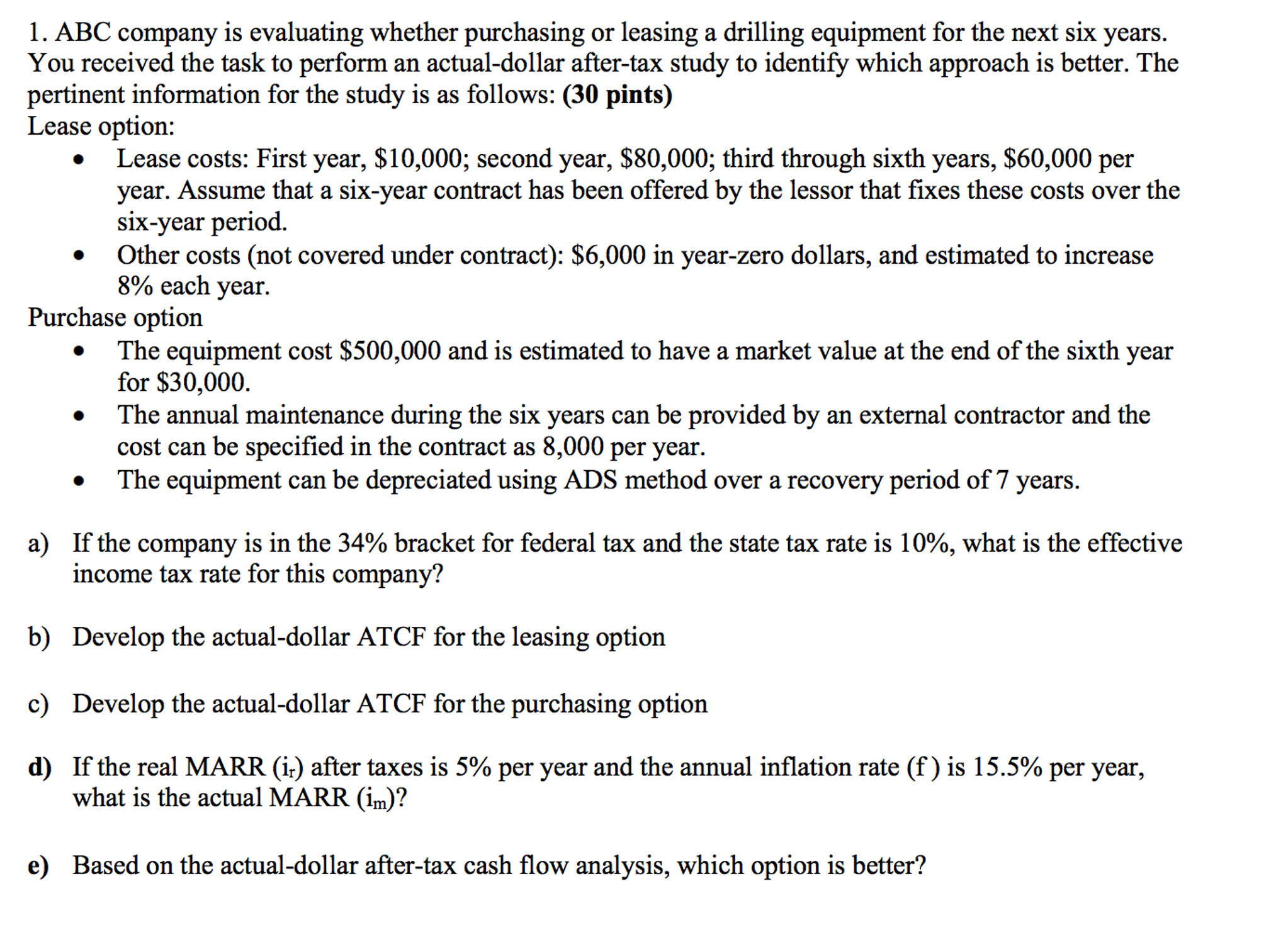

1. ABC company is evaluating whether purchasing or leasing a drilling equipment for the next six years. You received the task to perform an actual-dollar after-tax study to identify which approach is better. The pertinent information for the study is as follows: Lease option:

Lease costs: First year, $10,000; second year, $80,000; third through sixth years, $60,000 per year. Assume that a six-year contract has been offered by the lessor that fixes these costs over the six-year period.

Other costs (not covered under contract): $6,000 in year-zero dollars, and estimated to increase 8% each year. Purchase option The equipment cost $500,000 and is estimated to have a market value at the end of the sixth year for $30,000.

The annual maintenance during the six years can be provided by an external contractor and the cost can be specified in the contract as 8,000 per year.

The equipment can be depreciated using ADS method over a recovery period of 7 years.

a) If the company is in the 34% bracket for federal tax and the state tax rate is 10%, what is the effective income tax rate for this company?

b) Develop the actual-dollar ATCF for the leasing option

c) Develop the actual-dollar ATCF for the purchasing option

d) If the real MARR (ir) after taxes is 5% per year and the annual inflation rate (f ) is 15.5% per year, what is the actual MARR (im)? e) Based on the actual-dollar after-tax cash flow analysis, which option is better?

1. ABC company is evaluating whether purchasing or leasing a drilling equipment for the next six years You received the task to perform an actual-dollar after-tax study to identify which approach is better. The pertinent information for the study is as follows: 30 pintsO Lease option Lease costs: First year, $10,000, second year, $80,000; third through sixth years, $60,000 per year. Assume that a six-year contract has been offered by the lessor that fixes these costs over the six-year period Other costs (not covered under contract): $6,000 in year-zero dollars, and estimated to increase 8% each year Purchase option The equipment cost $500,000 and is estimated to have a market value at the end of the sixth year for $30,000 The annual maintenance during the six years can be provided by an external contractor and the cost can be specified in the contract as 8,000 per year. The equipment can be depreciated using ADS method ove a recovery period of 7 years a) If the company is in the 34% bracket for federal tax and the state tax rate is 10%, what is the effective income tax rate for this company? bO Develop the actual-dollar ATCF for the leasing option cO Develop the actual-dollar ATCF for the purchasing option d) If the real MARR (ir) after taxes is 5% per year and the annual inflation rate (f) is 15.5% per year what is the actual MARR (im)? e) Based on the actual-dollar after-tax cash flow analysis, which option is better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts