Question: Your company is looking to install a sensor on a gas pipeline to help monitor and regulate the efficiency of the compressors. The new sensor

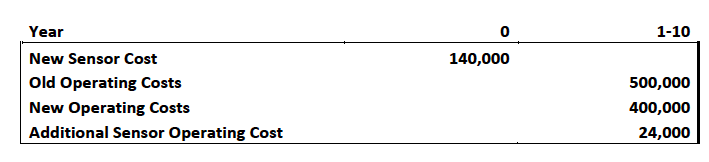

Your company is looking to install a sensor on a gas pipeline to help monitor and regulate the efficiency of the compressors. The new sensor will cost $7,000 per compressor and your company has 20 compressors along the section of pipe you plan to test the new product. The new sensors will be installed in year zero, and put into service in year 1. Operating costs for each sensor will cost $100/per month/per compressor. The new sensors will be depreciable 7-Year MACRS property, and start the first years deduction in year 1. If the sensors work properly the companys existing operating costs of $500,000 will decrease by 20% each year to $400,000 in each of years 1- 10. The existing compressors are already completely depreciated. Please use After Tax Present Worth Cost analysis to make your economic decision, and verify with an incremental ROR. Assume an effective corporate tax rate of 25%. Your companys minimum rate of return is i* = 15%, and assume your company has other income to utilize all deductions in the year incurred (expense scenario).

0 Year New Sensor Cost Old Operating Costs New Operating Costs Additional Sensor Operating Cost 1-10 140,000 500,000 400,000 24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts